Reining in Inflation

The recent monetary policy of the Reserve Bank of India which saw increasing repo rates has been done to curb rising inflation. There are numerous reasons for this sudden rise in inflation-both global and country-specific. What are these, and how can they be bridled in?

In a sudden move, the Monetary Policy Committee of the Reserve Bank of India unanimously decided to increase the repo rate (the rate at which RBI lends money to banks) by 40 basis points (bps), citing inflation concerns. This decision of 4th May 2022 was taken by the RBI in its off-cycle meeting. It was also followed by a 50 bps hike in the cash reserve ratio (CRR) to 4.5% which will suck out Rs.87,000 crore liquidity from the banking system. The proposed repo rate hike was the first in 45 months since August 2018 and will result in loans by the banks becoming costlier. The Governor of the RBI feared the strengthening of inflationary impulses along with the persistence of adverse global price shocks and that resulted in the surprise move of the RBI.

More money, fewer goods

Inflation is an unwelcome financial phenomenon. It happens by a rapid increase in the quantity of money as compared to the quantity of produce in different sectors. Milton Friedman had said, “Inflation is taxation without legislation.” Margaret Thatcher had said, “Inflation is the parent of unemployment and the unseen robber of those who has saved.” Inflation reduces the buying power of money. Today, the world over, inflation is rampant and that has badly affected the global economy.

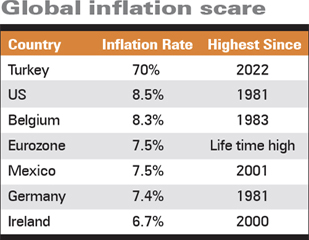

The figure for the US is frightening as it records a 41-year high inflation rate. India, till recently, was in the permissible zone of 4% to 6% set by the RBI, and this permissible zone continued for a long time. The inflation rate of India for the year ending March 2022 has gone up to 6.95% and that has threatened us. The economy of the US has contracted with high inflation and this will serve as a wake-up call for the world. Global inflation will impact everyone and our country cannot remain isolated.

Soft money

There are reasons for global inflation as well as country-specific reasons for India. Both have a cumulative effect on our country. The first reason for inflation everywhere in the soft money policy followed for the last two years during the ongoing Corona pandemic. Corona had virtually closed economic activities. Our GDP in the first quarter of FY 2020-21 had contracted to 23.9%. There were job losses. India, like many other countries, followed a policy of making bank loans cheaper to revive the economy. Repo rate and reverse repo rate were brought down historically. The monetary policy in the US was similar, bringing down Fed rates.

This resulted in having more money floating, but due to supply chain disruption caused by Covid, there was no proportionate quantity of goods in the market. The mismatch in the supply of money and the supply of goods for a considerable time has resulted in global inflation everywhere. There is an accepted economic principle that the monetary policy gives birth to inflation.

Price of fuel

The second and country-specific reason for growing inflation in India is the rising price of fossil fuels. India does not have the comfort of substantial petroleum reserves though we happen to be a big consumer of it. We have to depend on imports of crude oil to the extent of 80% of our requirements. Recently, petroleum prices went up very high and this has caused us a big problem. The Ukraine war has further complicated the issue. Rising petrol and diesel prices have affected the transport sector badly. The rise in freight charges has a multiplier effect on the cost of all goods including food items and vegetables. The price of items of our daily consumption is going up due to the rise in transportation costs. Even farmers have to bear the pain of higher diesel prices, and hence, the base price of farm produce also goes up.

"India does not have the comfort of substantial petroleum reserves though we happen to be a big consumer of it. We have to depend on imports of crude oil to the extent of 80% of our requirements. Recently, petroleum prices went up very high and this has caused us a big problem. The Ukraine war has further complicated the issue"

Dollar up

The third reason is the growing value of the US dollar. International trade is normally done through the US dollar and hence, if its value goes up then it adversely affects the cost of imported goods. For us, because of our imported fuel, it serves as a double whammy. A country like Sri Lanka, which depends mostly on imports, has almost become bankrupt due to the higher cost of goods and food items. An import-dependent country has to feel the problem of revenue deficit and this is true for India also as our imports are much higher than exports.

Another impact of the dollar becoming more valuable is the flight of foreign funds from the capital market. This results in our rupee falling in value and again, this has an impact on the price of imported goods. FIIs prefer to take their money to the US or other markets where the currency is stable. We had foreign exchange reserves of about $640 billion and now it has gone below $600 billion in a short span of less than a month. The rising value of the US dollar, rising price of fuel, and flight from the capital market are all inter-connected and they, in totality, are causes for rising inflation globally, and also in India.

War disruptions

The Ukraine war has not only fuelled the price of fuel but is also the fourth big reason for global inflation. Ukraine has been the biggest exporter of sunflower edible oil. It is also a big producer-cum-exporter of wheat and potatoes. Russia is a big country and besides being one of the big suppliers of fuel and gas, it is also an exporter of various commodities. The war has crippled the supply chain in the world. Its biggest impact has been the increasing price of wheat and edible oil and it has also affected the Indian food plate.

Wheat whammy

Earlier, we had the farmers’ strike for over a year for the repeal of farm laws, higher MSP and higher purchase of wheat by the government. Things have changed now, with the higher international prices of wheat. Farmers are selling wheat to the private sector at a higher price instead of going to the government-owned mandis. Farmers are happy and the private sector is happy exporting wheat, but consumers are in pain due to the high price they have to pay for their basic food. Rising food prices make it a big game for unscrupulous hoarders and it has a cyclic effect on the inflation of food items.

The inflation rate for April 2022 has been reported at 7.8%, which is the highest in the last eight years. It is not a good omen for FY 2022-23. The rise in inflation in April has been mainly because of the rise in food and fuel prices and it appears that the Ukraine war is hitting us hard.

However, recently, India has partially stopped the wheat exports amid shortage in the country.

Make more

What can be done to control rising inflation? Chester Bowls had famously said, “Production is the only answer to inflation.” It is a time tested formula. If there is a disruption in the global supply chain, we can counter it by producing more ourselves. The policy of ‘Atma Nirbhar Bharat’ of the government will prove to be an effective tool for countering the present inflation.

GST on fuel

The present-day mounting of both central and state taxes on petrol/diesel has to be reviewed. A few months back, the central government had reduced the levy of central tax and some state governments followed and reduced their levy of VAT, but some big states refused to follow this direction. The end result is that the price of petrol differs in a big way from state to state even by as much as Rs.20 per litre. There is also a similar big difference in diesel prices. States should think for the country as a whole and come together to bring petroleum products under GST. This is urgently required when petroleum prices are rising every day and when the end of the Ukraine war is not in sight.

All stakeholders like the private sector, the public sector and even common citizens should join hands and try their best to increase the country’s produce. It is hoped that the RBI will keep monitoring the situation and further increase the interest rate if deemed fit.