Hospitality Sector To Recover - Promises Greater Investment Opportunity

The Indian hospitality sector has taken a jolt and operating at 10-15% occupancy rate (ICRA Limited March 2020 rating) following the Covid-19 outbreak, but the pandemic has also given a new lease of life to the hospitality advisory sector. The niche sector is rolling up new strategies for their clients in the hotel and travel businesses. Nandivardhan Jain, CEO, Noesis Capital Advisors, envisions a significant correction in hotel evaluations, lending a greater opportunity for investors in the long run. An alumnus of the Narsee Monjee Institute of Management Studies (NMIMS), he founded Noesis in 2009 when a mere 10% of organised players vied for the Indian hospitality sector. With a vision to re-orient the Indian hospitality sector beyond property development and sales transactions, Jain currently functions across multiple verticals which focuses on brand conversion, operator search, consulting, valuations, feasibility, and research. He has recently introduced hospitality-focused events by organising workshops and knowledge series in enabling the sector to take tow of the evolving trends in the ‘new’ normal. He shares an insight into the sector, the Covid-19 impact, the challenges, and recovery solutions

"From an investor’s perspective, this is one of the best times to enter the hotel sector especially for players with additional liquidity and a gestation period of 6-8 years. The key is to focus on the way valuation is done”

“The next 12-18 months are very critical but we can expect the demand revival to begin from the next quarter. While organised players will be the first to capture the revival, it is an opportune time and we all should make the best use of it,” said Nandivardhan Jain, CEO, Noesis Capital Advisors.

With the implementation of the mandatory social distancing norms and other guidelines, the hospitality and travel sector have to operate businesses at escalated cost. But Jain’s positive outlook stems from more than a decade’s association with the hospitality sector when the glamour of the hotel industry attracted this NMIMS alumnus. His previous stint as a founding member of JLL Retail Capital Market brings in the experience to add multiple verticals within Noesis Capital Advisors, which he founded in 2009.

Noesis handles multi-disciplinary advisory and transactions ranging from hospitality to social development projects globally. Jain recognises that consumer-driven enterprises, including the hospitality sector, will shape up the Indian economy. The recent impact of the pandemic has given more impetus to hosting hospitality e-conferences, with a current nascent demand which Jain feels will bring players across the travel and hospitality sector onto a common platform. An excerpt:

"The hospitality sector is expected to become digital and technologically advanced. Keyless room access and check-in facilities followed by complete online booking is expected to emerge”

CC: How has the hospitality sector transitioned in the past 9-10 years?

Nandivardhan Jain : The scenario until 2010 in the organised hotel space was largely dominated by international chains with 87% of the hotel demand coming in from domestic travellers. This demand was primarily focused on the budget and mid-market hotels with limited demand for luxury and upscale hotels. With domestic chains expanding their portfolios post-2007, the budget segment and mid-market segment hotels became more competitive. In a scenario when international chains had a minimum inventory of 150 rooms per hotel which made it unviable for them to tap the Tier-II and Tier-III markets; the domestic chains managed to expand with a room inventory between 40-80 rooms that also captured demand from multiple segments. But the high cost of real estate lead domestic brands to focus on brand conversion and rapid expansions that leveraged them to become leaders in the budget and mid-segment today.

Serving it right

"The government has the opportunity to convert the outbound travel which at an estimated potential of 50 million travellers from India can be converted into domestic travel by creating Indian domestic circuits” "The government has the opportunity to convert the outbound travel which at an estimated potential of 50 million travellers from India can be converted into domestic travel by creating Indian domestic circuits”

CC: What are your niche areas as a hospitality advisory service?

We primarily work around the need to build an efficient and profitable hotel. Our focus is primarily on building a project which is profitable and efficient enough to handle its own debt.

CC: Are you a one-stop-shop solution provider for the hospitality sector?

Our focus is primarily on managing asset (class-wise) with a focus on hotels and resorts, lodgings, hostels, service apartments, co-living, on tourism driven projects, hotels transaction and operator search. The other key areas include valuations, research, and consulting. Integrated professional services include feasibility study, project management, transaction management, debt syndication, and private equity. We have recently added a new venture Ngage Hospitality which focuses on organising events for the hotel industry, bringing the sector on a common platform.

CC: Do you also enable mobilising funds for hotel chains?

Yes, we do strategy growth assignments for hotel chains to help them identify the underlying causes of the expenses, cost analysis, revenue management and so on.

Covid cracks and mends

CC: How is your advisory business coping during the outbreak?

We have no immediate plans of raising funds as we are currently self-sufficient in sustaining our company for the next 3-4 years under the same scenario. Instead, we are investing in ourselves and hiring new people to enhance our skill set to understand the flux in consumer behaviour.

CC: How badly hit is the hospitality and travel segment?

The entire chain of the tourism industry is broken. The widespread impact of the Covid-19 has led to the closure of all international borders, there is a cut in travel budgets for corporates unless it is absolutely critical. The reduction in income levels has induced employee pay cuts, furloughs, and job losses.

CC: Is there any demand for the hospitality sector in the current scenario?

Contracted demand and overleveraged debts have put the industry in a tough spot. In the current scenario, the demand is concentrated in the areas of the ‘Vande Bharat’ Mission, medical staff, and aviation crew. This demand is also largely restricted to top 8-10 cities in India making it difficult to sustain. In the next 24 months, the industry needs to work together to survive these difficult times.

CC: What are the current risks in the hospitality sector?

From the property owners’ perspective, there is distress in the market. However, wherever restructuring is possible, financial institutions are already working on the mandates to ensure money is not lost. We have observed that over-leveraged assets are either diluting equity or are liquidating as the next 24 months are very critical. We cannot expect the same performance to be back before that. Currently, the Indian banking industry has an exposure of more than 40,000 crores towards the hotel asset class, out of which INR 11,000 crores is under stress. Stress asset figures are going to double up until or unless the government comes up with an industry-specific bailout package.

CC: Is it a good time to invest in the sector?

Yes, from an investor’s perspective, this is one of the best times to enter the hotel sector especially for players with additional liquidity and a gestation period of 6-8 years. The key is to focus on the way valuation is done. It is important to consider gross operating losses for the next 36 months whenever the valuation process is done. Replacement methodology should be considered.

CC: What is the current status of the hospitality sector?

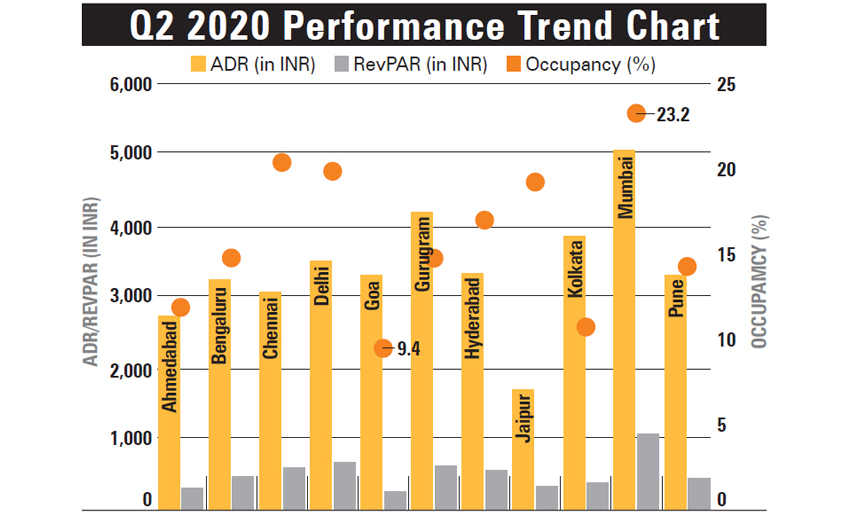

Of the total supply of a million rooms in India, 160,000 odd rooms are in the organised market segment. With a national average occupancy of 65% pre-COVID, we expect the demand to contract by 30-40% in the short-term. But we also foresee a demand trend that will be leveraged by hotels in the organised segment.

Bracing up hoteliers

"The hotel industry recovery is only expected to begin by H2 2021. The recovery curve is dependent on the availability of the proposed vaccine that is expected by the year end or beginning of next year"

CC: When do you think the hotel industry will recover?

The hotel industry recovery is expected to begin by H2 2021. The recovery curve is dependent on the availability of the proposed vaccine that is expected by the year-end or beginning of next year. Even so, post H2 2021, it will be another 18 months or more to reach the same levels of business generated in 2019. We can expect the industry to be back on the previous peaks by 2023.

CC: What are the immediate solutions to recovery?

The government has the opportunity to convert the outbound travel which at an estimated potential of 50 million travellers from India can be converted into domestic travel by creating Indian domestic circuits. Heritage properties can be converted into self-sustaining properties. Khajuraho is a classic example of the circuits that can be developed. Developing of such circuits will allow tourism development within 100 km radius of these destinations which will most likely increase employment opportunities and uplift the economy.

The second emerging trend is ‘staycations’ and weekend getaways which are within 2-4 hours of drive by a personal vehicle as people are not yet comfortable with public transport facilities.

CC: Your tips on salvaging hotel businesses in the next six months.

Solutions vary from one hotel to the other and owners with existing operational properties, should either dilute equity or look at restructuring with financial institutions. However, restructuring will be possible in a scenario where the property is already not over leveraged.

In the current scenario, for under-construction properties with original plans of developing a luxury or upscale hotel, it is advisable to rethink and change the hotel segment into a budget or mid-segment hotel wherever possible. Independent hotel operators are also advised to tie-up with a brand but during the conversions, negotiate hard on legal and commercial terms with these brands. The owners are suggested to tie-up with a brand only if their vision matches with the brand.

CC: How has technology impacted the hospitality sector post the pandemic?

As a result of the crisis, the sector is expected to become digital and technologically advanced. Keyless room access and check-in facilities followed by complete online booking is expected to emerge in the hotel sector. Secondly, we can expect independent hotels getting converted into branded hotels to attract demand to their property in the new normal.

CC: Is there a global standard to ensure hygiene and safety?

Singapore tourism board has appointed KPMG and Ernst & Young as operational auditors to ensure the policies and standard operating procedures (SOPs), put in place by them are adhered to by hotel owners. Hotels will be certified by the above consultants to build on their safety quotient and trust amongst guests in these certified properties. Hoteliers in India are gradually understanding the impact of the pandemic and have approached Jain’s team in the brand conversion segment during the lockdown.

CC: What are consumer expectations in the revival stage?

In a consumer survey that we conducted during the lockdown, 70%+ of respondents said that health and hygiene is the top priority in charting out travel plans. They are comfortable paying 10-15% premium for a branded hotel for their next vacation as they trust these chains more for the level of SOPs that they are likely to implement for ensuring safety measures. Adapting technology to service in the form of zero touch room unlocking and additional facilities not only adds to the hygiene but also provides customer experience that is expected to attract demand for these hotel players.

Syncing travel to hospitality

CC: What has been the impact of the pandemic on the travel sector?

The travel sector is expected to witness a gestation period of 18-24 months before we expect to go back to the pre-pandemic travel routine. Corporate travellers that accounted for more than 60% of the overall travel are expected to be reduced to the basic critical travel in the new normal as a step towards cost rationalisation.

CC: Your tips on salvaging the travel sector in the next six months.

The travel industry is advised to follow SOPs diligently as the chances of exposure in the current scenario are higher. We anticipate private travellers opting for nearby destinations which are accessible through personal cars covering a distance of 2-4 hours. The industry has to re-invent and look at the domestic market while creating niche travel plans for the domestic outbound travellers.

CC: When do you think the travel sector to recover?

The recovery depends on the development of the proposed vaccines and when cross country borders become fully functional. This segment is expected to fully recover by 2023.