Adar charts out SII’s Covid-19 vaccine strategy

Adar Poonawalla, CEO, Serum Institute of India (SII) is prepping up to deliver some 300-400 million doses of its potential vaccine ‘Covishield’, by December 2020. In the latest development, he said, that Covishield is going to be the first COVID-19 vaccine that they hope to launch if trials are successful in the UK and India. Falling back on the encouraging trial results of the single-dose vaccine candidate, ChAdOx1 nCoV-19, SII will soon swing into action with its annual manufacturing capacity of 700-800 million doses in their existing facility. “If we look at the four months that we got here we could make around 300 million by December. Typically, if this vaccine is going to be a two-dose vaccine, realistically, it is going to be three to four years before everyone on the planet gets vaccinated to the fullest extent with two doses”, said Adar. The vaccine is being developed by the Jenner Institute at the University of Oxford in partnership with Britain’s AstraZeneca and SII as the chosen manufacturer. SII will be making the vaccine from scratch. Pending the successes of the impending Phase 2 and Phase 3 trials, Adar expects the vaccine to reach the people of India in large numbers by March 2021 and will cost around Rs.1,000. SII will soon be submitting their documents to gain permission for the Phase 2 T-trial to the Drugs Controller General of India (DCGI) within the next few weeks to structure out the design, type, and other aspects of the trial. He envisages to go into actual trials in the hospital with patients within a month’s time. For the impending and crucial Phase 3 trials, SII is considering the hospitals around the densely populated Mumbai and Pune areas as they have also been reporting higher incidences of the outbreak. “The size of the trials would be determined by the statisticians later. But it’s going to be around a few thousand patients close to maybe 5,000”, he said. Adar ensured that with many joining the fray for potential COVID vaccines, SII would focus on the safest and best vaccine, offering the “longest-term” protection to avoid patients going back for repeat shots. In the future, SII plans to launch a new COVID vaccine almost every two months. “Starting with the Oxford product first because that’s way ahead in the trials. That way we don’t depend upon just one vaccine. I am quite sure more than one vaccine out of the five that we have chosen will be successful,” he said.

Rajeev Gupta, is new CFO, L&T Tech

Rajeev Gupta joins L&T Technology services as the new CFO, replacing P Ramakrishnan, who is expected to assume a new role with the L&T Group. Rajeev relinquished his role as CFO Birlasoft, where he displayed successful execution of a complex acquisition with merger-demerger as well as the integration of the acquired company for the company. An alumnus of the Institute of Chartered Accountants of India and Narsee Monjee, Mumbai, he brings in 24 years of experience in Financial Management, of which 17 years have been dedicated to the tech sector.

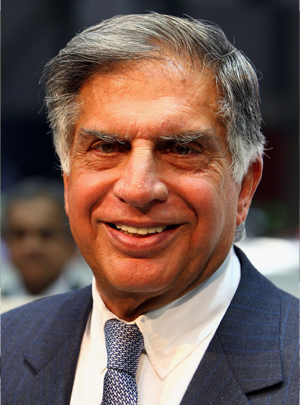

Leadership dynamics at play at Tata Sons

The move to induct Noel Tata as a Director on the board of Tata Sons, the holding company of all Tata Group firms, has once again gained momentum. While a final decision is yet to be taken, experts point out that certain Tata insiders are batting for Noel’s appointment to the Tata Sons’ board. As Bombay House watchers anticipate new leadership dynamics to play out, company veterans have been long lobbying with Ratan Tata for a Tata family member to be on the board of the holding company of the $113-billion conglomerate. It is well understood that Noel’s proposed induction is backed by his half-brother Ratan N Tata, Chairman Emeritus, Tata Sons. His onboarding is seen as part of a bigger restructuring plan by veterans in the group. According to company insiders, “If Noel is inducted to the Tata Sons Board, it could be a precursor to appointing him as a successor to Ratan Tata.” They said that “The equation between Noel and Ratan has improved over the last few years, especially after Noel backed his brother Ratan Tata against his brother-in-law, Cyrus Mistry.” Noel Tata is currently the Chairman of Trent (that operates Westside) and Tata Investment Corporation. He is also the Managing Director of Tata International and the Vice Chairman of Titan Industries Ltd. Noel is married to Aloo Mistry, the daughter of Pallonji Mistry and sister of Cyrus Mistry who was recently overthrown by the Chairman of Tata Sons. Besides Noel, Pramit Jhaveri, a trustee and ex-Citi India head, is also being considered by the Trusts to onboard Tata Sons. He was inducted to the board of Trusts in February this year.

Aditya Puri is top paid executive banker

Aditya Puri, Managing Director, HDFC Bank, remains India’s highest-paid chief executive banker during fiscal year 2020 (FY2020). His salary and prerequisites surged 38% to Rs.18.92 crore in FY 2019-20 in comparison to the last fiscal. Puri who has been leading HDFC since the past 25 years since its inception, has earned an additional Rs.161.56 crore by implementing stock options during the year. As per RBI rules that restrict the age of top bank executives, Puri is slated to retire in October 2020 when he turns 70 years. Other top tier banking executives in the private lending sector include ICICI Bank’s Managing Director and CEO Sandeep Bakhshi in second position. Bakhshi’s gross earnings stood at Rs.6.31 crore, as per ICICI’s annual report. Bakhshi took charge in October 2018, and has earned Rs.4.90 crore in FY19 as a part year’s payment, as per the bank’s annual report. In third position is Amitabh Chaudhary, MD, and CEO of Axis Bank. He received an annual sum of Rs.6.01 crore for FY20 in comparison to Rs.1.27 crore for the last quarter of FY19. Uday Kotak, Managing Director of Kotak Mahindra Bank sums up his stakes in fourth position amongst the top banker’s list. His annual salary took a dip in FY20. His gross earnings in FY 19 was Rs.3.52 crore, which has now dropped by 18% to Rs.2.97 crore.

Ratan Tata – Layoffs not the solution

Philanthropist Ratan Tata, Chairman Emeritus Tata Sons and Chairman of Tata Trusts nudged businesses on the art of balancing business with sensitivity. Speaking at the YS Leadership talk, he reacted strongly to the post-Covid-19 scenario which had in the lockdown phase witnessed unceremonious workforce exodus through industry-wide and company layoffs of both blue-collared workforce and migrant labourers. He clarified that while making money is not bad, it must be done ethically, and that laying-off workforce cannot be the only solution. He pointed out to the unpreparedness displayed by employers in dealing with the lock down situation that continued to traditionally focus on profits or business bottom lines even during the crisis. Ratan Tata has hit out very solemnly on this very ruthless business insensitivity. He reiterated that there is a need to look into the welfare of all stakeholders and not remain rigidly skewed to the expectations of just company shareholders. His anguish was particularly directed at the plight of the migrant workers, who were left to fend for themselves. He has implored business owners to contemplate and take lessons from the COVID disaster and not succumb to another knee-jerk reaction syndrome.

Biocon unveils novel biologic therapy to treat COVID-19 patients

Kiran Mazumdar Shaw led Biocon Ltd. has gained inroads by re-purposing its existing biologic therapy Itolizumab (ALZUMAb), for treating Covid-19 patients. The Drugs Controller General of India’s (DCGI) has approved Biocon to market its ALZUMAb Injection (25mg/5mL solution) for emergency use in India, making it the first novel biologic to be approved anywhere in the world for treating moderate to severe complications in Covid-19 patients. It will be manufactured and formulated as an intravenous injection at the bio-manufacturing facility at Biocon Park, Bengaluru. Itolizumab, an anti-CD6 IgG1 monoclonal antibody was launched in 2013 and has a 7-year proven track record, as an existing prescribed biologic for the treatment of acute psoriasis. Each injection will cost Rs.7,950 per vial and based on an average body weight of 60 kg, the therapy cost of a single dose comprising four vials is estimated at Rs.32,000 (MRP). The Itolizumab therapy will help Covid-19 patients who develop cytokine release syndrome (CRS) in moderate to severe ARDS (acute respiratory distress syndrome). Normally, cytokines are immune response army of cells which naturally encounters a germ but can get out of control and attack the very immune system that it is meant to protect as a result of an infection, autoimmune condition or any other disease. Itolizumab will intervene by fighting these unruly cytokine cells thus reducing the ‘cytokine storm’ and deadly inflammatory response. A randomised control trial has indicated that all the patients treated with Itolizumab (ALZUMAb) had responded and Biocon is hopeful of saving many critically ill Covid-19 patients with this drug. “As an innovation-led biopharmaceuticals company, I am proud of the successful outcome of the pivotal study we conducted with our novel immuno-modulating anti-CD6 monoclonal antibody, Itolizumab, which has proven to be an efficacious intervention in treating the serious hyper immune response seen with Covid-19. The data is compelling, and I am confident that this ‘first-in-class’ biologic will save lives and help reduce the mortality rate in our country,” said Mazumdar-Shaw, Executive Chairperson, Biocon.

Rajeev Joisar is new MD of Bombardier rail arm, India

Bombardier Transportation, the rail equipment division of the Canadian multinational firm Bombardier Inc., has appointed Rajeev Joisar as Managing Director for its India operations. Rajeev will be responsible for mandating business development and sales, also project execution and services. His role is expected to nurture and further develop and strengthen the company’s customer base as Bombardier grows a sustainable business in India. He has in the past held multiple roles during his career span with Bombardier and has considerable experience in managing complex multi-site cross-divisional projects. He has also held key management positions in multiple functions such as operations, strategic sales, project management and bid management. His vision and leadership have helped its India team in bagging two significant contracts with the combined value of more than half-a-billion euro. The first being the May 2020 Delhi-Meerut Regional Rapid Transit System and the other being the July 2020 Agra-Kanpur Metro Project. Rajeev is a certified engineer specialised in Electronics and Communications from Vadodara.

Pichai unveils Google’s digital India plans

Tech giant Google plans to invest over ₹75,000 crore ($10 billion) in India over a period of 5 - 7 years. Sundar Pichai, CEO of Google and Alphabet said that the investment in India will be made through equity investments and tie-ups. The move marks Google’s confidence in India’s digital economy in the near future. Investments will be focused around four key areas: affordable access and information to every Indian in their native language, building new products and services that serve India’s unique needs, also empower Indian businesses in their digital transformation, and leverage technology and Artificial Intelligence for social good in healthcare, education and agriculture. “Today, 26 million SMBs are now discoverable on Search and Maps, driving connections with more than 150 million users every month. What’s more, small merchants across the country are now equipped to accept digital payments. This has made it possible for more small businesses to become part of the formal economy, and it improves their access to credit,” he said.

Roshni Nadar takes over as Chairperson HCL

Honouring a strategic succession plan, Roshni Nadar Malhotra has stepped up to lead HCL Technologies as Chairperson, becoming the first woman ever to head an Indian publicly traded software firm. She moves up from her previous role as Non-Executive Director and Vice-Chairman, HCL. As 78 year old Shiv Nadar steps down to make way for his daughter, he will continue to retain his position as Managing Director and has been designated as Chief Strategy Officer of HCL Technologies. Ranked 54th on the Forbes list 2019 of the world’s 100 most powerful women, Roshni is also the richest woman in India, as per the 2019 IIFL Wealth Hurun India Rich List. She was elevated as CEO and Executive Director of HCL in 2013 and has been strategically guided to accomplish her roles within the organisation. An alumnus of the Northwestern University and the Kellogg School of Management, Roshni is also a wild-life conservationist and philanthropist. In 2018, she established the Habitats Trust that aims to protect India’s natural habitats and its indigenous species by creating and conserving sustainable ecosystems through strategic collaborations with stakeholders. Prior to onboarding HCL, she wore multiple hats engaging herself as the trustee of the Shiv Nadar Foundation, which runs on the not-for-profit Sri Sivasubramaniya Nadar College of Engineering, Chennai. She is chairperson of VidyaGyan Leadership Academy, a leadership platform for the development of economically underprivileged, meritorious students in Uttar Pradesh. She has been nurturing talented leaders from rural India to bring about changes in their respective communities, villages, and the nation. A trained classical dancer and a mother of two, she is the better half of Shikhar Malhotra, Vice Chairman of HCL Healthcare.

Nitin Bagamane resigns from Café Coffee Day

Nitin Bagamane, the interim COO of Coffee Day Enterprises Limited (CDEL) which operates Cafe Coffee Day (CCD), has resigned exactly a year after his appointment. Stating personal reasons, while Bagamane will not be devoting his full-time services to the company, he will, however, continue as a member of Executive Committee, post his resignation. He was an early investor and member of the executive committee of CDEL that was formed post the sudden death of its former chairperson, V G Siddhartha. He has since worked in tandem with Malavika Hegde, CEO and Siddhartha’s wife, the interim Chairman S V Ranganath and CFO R Ram Mohan Roy, to financially revive the Bengaluru based CCD chain. CCD has been under pressure to reduce borrowings initiated by its former departed founder chairman. Bagamane has held diverse portfolios such as director with Tanglin Developments, the real estate business of the company, and during his tenure as interim CEO, he helped to divest the real estate subsidiary, Global Village and Tanglin Developments, to US private equity firm Blackstone Group. CDEL completed the sale and received Rs.2000 crore as the first tranche as per stock exchange filing. This transaction mobilised CDEL to clear a third of its accrued bank debts.

L&T rejigs board of directors

Multinational conglomerate Larsen and Toubro (L&T) has inducted non Executive Director, Subramanian Sarma as an Executive Director, as part of a board rejig. Sarma, the current CEO and MD of L&T Hydrocarbon Engineering, a wholly owned subsidiary of L&T will expedite duties as whole-time Director and Senior ExecutiveVice President (Energy), with effect from August 19, 2020. He will be responsible for L&T’s power business and hydrocarbon businesses. An alumnus of IIT Bombay, Sarma brings in over 37 years of experience, working across India and the Middle East, handling the company’s oil & gas value chain across portfolios including executive management, business development, project management and process engineering. In other moves, the company has elevated S V Desai and T Madhava Das to the Board in its strategy for aggressive business forays. Desai takes on as whole-time Director & Sr. Executive Vice President (Civil Infrastructure) shouldering responsibilities in L&T’s heavy and transportation infrastructure businesses. Desai, also an IIT (Madras) alumnus began his 23 years association with L&T in 1997, engaging in senior roles across multiple divisions of the conglomerate. Madhava Das will serve as whole-time Director & Sr. Executive Vice President (Utilities) with responsibilities in the power transmission & distribution areas, also the company’s Water & Effluent Treatment (WET) businesses. Madhava Das, an alumnus of NIT Calicut and XIM Bhubaneswar, joined L&T in 1985 and has since held multiple key positions in the electrical business of L&T-ECC.

Lavasa appointed as VP of ADB, to forgo Chief EC role

Election Commissioner (EC), Ashok Lavasa has been appointed as Vice President with the Asian Development Bank (ADB) for helming roles within the bank’s private sector operations and public-private partnerships. Lavasa has yet to step down as the EC but is slated to assume office with ADB in September 2020 with a tenure of three years. He succeeds Diwakar Gupta, whose term with the Manila headquartered regional bank ends on August 31, 2020. Lavasa’s ADB move cuts short his chance of becoming the next in line Chief Election Commissioner (CEC) in 2021, heading the poll panel. This is the second time in history that marks the premature exit of a presiding EC, especially since Lavasa had two more years left to complete his term as the EC of India. A retired 1980-batch IAS officer of the Haryana cadre, Lavasa was appointed as EC in January 2018. He retired as Union Finance Secretary, and also held key positions as Environment, Forest and Climate Change Secretary and Civil Aviation Secretary. As joint secretary in the Department of Economic Affairs in 2001-02, he looked after matters pertaining to ADB.