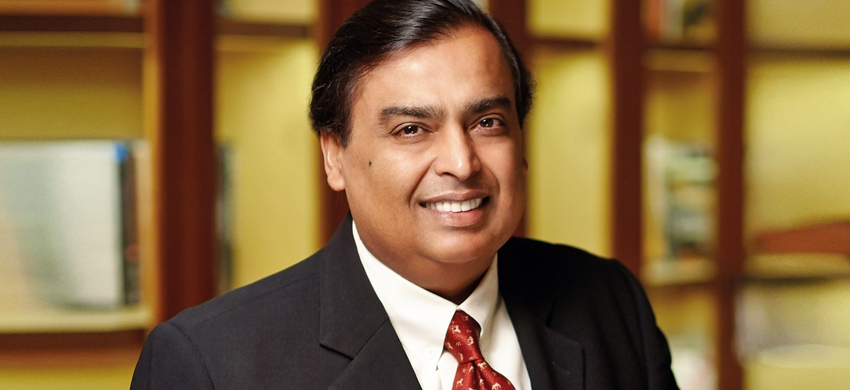

‘Trillionaire’ hopeful list adds Mukesh Ambani, Zuckerberg, Jack Ma

Mukesh Ambani could predictably become a trillionaire in 2033 at 75 years, as per the study by the advisory platform – Comparisun, along with Jeff Bezos. Bezos is touted to become the world’s first to attain the coveted wealthiest ‘trillionaire’ status. While the study compared 25 individuals, only 11 amongst them are seen to have a realistic chance of becoming a trillionaire during their lifetime. Forbes’ valuation of Mukesh Ambani, Chairman and Managing Director of Reliance Industries (RIL) stands currently at $36.8 billion. Other prominent names predicted to make the trillionaire mark are Chinese real estate tycoon Xu Jiayin who is likely to trail Bezos as the word’s second trillionaire in 2027. Alibaba’s Jack Ma could become a trillionaire in 2030 at 65 years. Facebook founder Mark Zuckerberg’s current rate of growth could see his worth being pegged at $1 trillion in 2035 at 51 years.

Google successfully lobs for Microsoft’s Anil Bhansali

Anil Bhansali has been appointed as Vice President of Engineering for Internet giant, Google’s cloud business in India. In his new role, Bhansali will take charge of all software development support endeavours for India’s Google Cloud business. Google’s strategic pitch for Bhansali leverages his association with Microsoft for the past 28 years. In his previous role as Vice President of Azure, Microsoft’s cloud division, Bhansali professed as the site leader for the company’s research and development in India. He has also led engineering roles across Microsoft’s office, search, and window divisions. Bhansali’s appointment follows Google hiring Karan Bajwa, another ex-Microsoft executive as the Managing Director for its Cloud Division in India. The recent appointments at Google Cloud indicate Google’s determination to take on all its rivals in India - Amazon Web Services (AWS), Azure, and Alicloud.

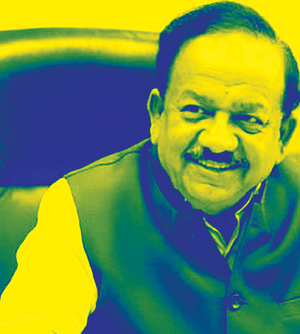

Harsh Vardhan, nominated as WHO Executive Board Chairman

Harsh Vardhan, Union Health Minister (India), has been nominated as the next Executive Board Chairman of the World Health Organisation (WHO), pending his election at the WHO's executive board's meeting on May 22, 2020. While the election itself is a procedural formality, the 194-nation led - World Health Assembly (WHA) has signed off on the proposal to appoint India’s nominee, Harsh Vardhan to the executive board. A trained ENT surgeon, he will replace H Nakatani, the current advisor for international affairs to Japan’s health minister. Harsh Vardhan has been leading India’s battle against Covid-19 and in his new role as the head of the 34-member Executive Board, he is mandated to implement the decisions of the WHA. Working in close association with Tedros Adhanom Ghebreyesus, Director General (DG), WHO, Harsh Vardhan, is likely to continue in the executive board post termination of his year-long term. As the WHO Chairman, he will also weld significant authority in the shortlisting process of the upcoming WHO Director General when Ghebreyesus ends his five-year-tenure in May 2021. “It is not a full-time assignment… But Dr Harsh Vardhan will be required to chair the executive board’s bi-annual meetings,” according to senior government officials. Harshvardhan’s nomination is a fall-out of a unanimous decision taken last year by WHO’s South-East Asia group that New Delhi would be elected to the executive board for a three-year-term commencing May 2020. The decision then had firmed up that India’s central government nominee would be the Executive Board Chairman for the first year. The WHO board is required to shortlist candidates whose candidature is put before the WHA for election by a secret ballot as against the earlier process wherein the executive board would select the DG, WHO and get its choice vetted by the health assembly.

Zee5 rejigs leadership positions

Anita Nayyar has taken over as head of customer strategy and relationships with streaming services, Zee5, as she steps down as CEO of Havas Media Group (India and Southeast Asia). Besides, Zee5 has also appointed Jayesh Easwaramony as a consultant to drive its advertising, user data and audience-related initiatives, along with new hire, Dhruvadeep Roy to take over as Director-Product and Adtech. An alumnus of IGNOU, Nayyar brings in 20 years of experience working across various Indian and international firms and will primarily be responsible for building the agency-partner ecosystem for ZEE5’s India business. Easwaramony has since relinquished his role with advertising firm InMobi and his previous responsibility in driving its APAC business. Armed with 20 years of experience across brands, Zee5 gains from Easwaramony’s expertise in digital advertising and data monetisation. In previous roles, he has had stints as a consultant and executor across companies such as Frost and Sullivan, Tata Sky, Star India, and the Tata Group. Zee5 has also cashed in on Dhruvadeep Roy’s leadership skills in harnessing platforms and product in his previous role as Head of digital platforms with DAZN Sports Streaming Service across the UK, US, Canada, and the APAC markets.

Sahu appointed to Maruti Suzuki board

Maheshwar Sahu has been appointed as Independent Director of Maruti Suzuki India Limited (MSIL) and replaces Renu Sud Karnad who has since joined the board of HDFC Bank Limited. As per a regulatory filing to the Bombay Stock Exchange, Sahu’s tenure has been fixed for five years, effective from May 14, 2020, until May 13, 2025. An ex-senior civil servant, Sahu has had over 30 years of leadership experience. He was Vice Chairman & MD, Gujarat Industrial Development Corporation (GIDC) before he retired as Additional Chief Secretary (Industries & Mines).

Wipro Chairman mobilises PremjiInvest for Covid-19 vaccine

Philanthropist Azim Premji has capitalised in the US-based biotech firm, Moderna through his private investment arm, PremjiInvest. Moderna is at the early stages of manufacturing a vaccine to fight Covid-19. The Wipro Founder-Chairman’s early investment in Moderna a few years ago was reported to the tune of $25-$30 million and is one of five such firms that Premji has invested in the US via a dedicated team in Boston. Despite the fund selling off some of its holdings, it still owns a stake in Moderna. PremjiInvest manages billions of dollars in assets and is among the biggest family offices in India that ideally serves ultra-high-net-worth (UHNW) investors. PremjiInvest has been consciously scouting for firms that work in the health-oriented sector developing low-cost immunity products, care, and delivery. Premji set up PremjiInvest fund in 2006, to differentiate its holdings from that of his philanthropy arm-the Azim Premji Foundation and its core IT business in Wipro. He eventually merged his investment arm with the Foundation in 2018, steering more room for generating funds for his philanthropic pursuits.

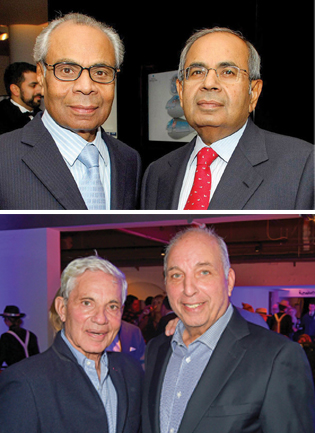

Hindujas and Reubens top UK’s wealthiest chart

Indian origin siblings and business magnates — the Hinduja and Reuben brothers share the ‘second’ position on Britain’s - ‘The Sunday Times Rich List 2020’ tally, as James Dyson, British inventor-entrepreneur with £16.2 billion topped the list. Britain’s top wagers on the 1,000 richest chart witnessed Srichand and Gopichand Hinduja, spearheading the Hinduja Group of companies, slipping to the 2nd position as they lost £6 billion due to the recent Covid-19 crisis as one of the reasons for relinquishing their numero uno slot from last year. But, Mumbai-born billionaires David and Simon Reuben, have retained their spot two position despite their loss of £2.66 billion over the past year. Russia’s biggest foreign investors in the metal industry in the 1990s – the Reuben brothers with a fortune worth £16bn hold 5% stake of the world’s aluminium output through their Trans-World Metals and other investments real estate holdings. The Hinduja Group operates across sectors such as automotive, oil, banking and finance, and speciality chemicals also runs IndusInd Bank. As the oil pricing dipped, it has hit Hinduja-backed Gulf’s oil and lubricants division. Its marine arm has also taken a beating following the downturn in world trade. Manufacturers of the iconic Ashok Leyland trucks, their share price was halved over the past year which also fell sharply in their Pune-based banking outfit, IndusInd when the brothers attempted to increase their holding while the stock continued to remain cheap. Mining major Anil Agarwal fell to 5th position with a loss of £2.07 billion and an estimated fortune of £8.5 billion, while Lakshmi N Mittal lost £3.88 billion to drop 19th on the list with a fortune estimated at £6.78 billion.

Credit Suisse re-appoints Puneet Matta

Puneet Matta re-joins Credit Suisse as head of its wealth management business in India. In fact, Matta held this position as Head of Wealth Management for Credit Suisse from 2007 to 2011 and has been re-appointed to the same post as he takes over this mantle once again nearly a decade later. He will be relocating from Singapore to Mumbai to leverage his leadership experience in team-building and businesses goals. With 30 years of experience across wealth management as well as corporate and investment banking, Matta recently moved over from his leadership role with Union Bancaire Privee (UBP), in its the NRI and ISC segments, also, in the external asset managers (EAM) business. Matta began his career with Citibank and has held previous roles with Aon, a global professional services firm.

Jeff Bezos, world’s first Trillionaire by 2026

Amazon founder, Jeff Bezos is predicted to become the first-ever trillionaire by 2026. With a net worth of $143 billion, he is said to become the world’s first trillionaire within the next six years! His future wealth projection is based on the research conducted by Comparisun, an advice platform for small businesses. The advisory platform showed that 56-year old Bezos would become a trillionaire (with $1,000 billion) by 2026 at 62 years. The research platform based its projection on the average percentage of annual expansion recorded over five years and extrapolated it to future years. According to Bloomberg’s Billionaire Index, Bezos’s total fortune grew year-to-date by nearly 25% (over $28 billion), to the latest estimate of $143 billion. However, a study reported in the Washington Business Journal said that “The math behind the study that makes this estimate doesn’t make much sense because it assumes that Bezos’ wealth will grow by an average of 34% each year, as it did over the past five years. But Bezos could reach that average and still be way off a trillion because averages include wide ranges.” The report said that Bezos’ wealth is tied to his shares in Amazon and assuming his space company, Blue Origin LLC, fails to become its cash cow, Bezos will not be able to sell any more stock and Amazon would have to be worth $9 trillion in five years for Bezos to be wealthier. With the demand for home deliveries spiking up in the wake of the pandemic and the subsequent lockdowns, Amazon recorded sales of over $75 billion during the January-March period, an increase of from $60 billion during the same period last year. Amazon had reported a revenue of $281 billion in 2019.

Ajay Dixit to exit Cairn Oil & Gas

Ajay Dixit, CEO of Vedanta’s oil and gas division, is all set to step down and quit the company by the month-end. This makes him the fifth billionaire to call it quits at the oil and gas arm of the Anil Agarwal-led Vedanta Group. Dixit had replaced Sudhir Mathur when Mathur resigned from the company but had the shortest tenure of just over a year since mid-April of 2019 when he officiated as the head of Cairn Oil & Gas. The company runs one of the biggest on-land fields in Barmer, Rajasthan. He was also the acting CEO of Vedanta’s aluminium and power business before taking over as the CEO of Cairn. The company statement said that Dixit is superannuating from the company at the end of his five-year term in May 2020. However, industry buzz is that Dixit exiting the company coincides with Agarwal’s announcement to takeover Vedanta privately by offering to buy off minority shareholders. Agarwal’s Vedanta Resources has offered to buy 48.94% held by public shareholders at Rs.87.5 per share. In April 2017, Cairn India was merged with Vedanta and delisted from the stock exchanges. Vedanta Ltd.’s shares have fallen more than 40% in 2020.

TikTok’s gain is Disney’s loss

TikTok has roped in Kevin Mayer as its new Chief Executive as he relinquished his leadership position as streaming executive with the Walt Disney Co. Mayer, will also hold office as the Chief Operating Officer (CEO) of ByteDance, the Chinese conglomerate that owns TikTok the app for making and sharing short videos that has gained global popularity in the aftermath of the Covid pandemic. Mayer will thus likely provide a clear link between TikTok and ByteDance’s leadership in Beijing, playing dual roles by managing both the companies. Mayer joined Disney in 1993, moving over to run Playboy.com in 2000. He soon returned to Disney to work on Go.com, a web portal that eventually failed, and other Disney websites, including ESPN.com, before moving to strategic planning.

Manoj Jain adds up as MGL Chairman

Manoj Jain takes over dual responsibility following his appointment as Chairman of gas distributor Mahanagar Gas Ltd (MGL), and will continue to expedite duties in his current role as Chairman and Managing Director (CMD) of GAIL. A mechanical engineer, Jain has had a long inning of over 34 years with GAIL across the company’s various divisions - business development, projects, O&M, petrochemicals, pipeline integrity management and marketing. As the CMD of GAIL, Jain automatically becomes Chairman of its subsidiaries - GAIL Global USA Inc, GAIL Global USA LNG, GAIL Gas, Brahmaputra Cracker & Polymer and Konkan LNG. MGL is the sole authorised distributor of compressed natural gas and piped natural gas in Mumbai, Thane, Navi Mumbai, and its adjoining areas and has proposed to expand further into Raigad district. It supplies PNG to over 1.27 million households and over 4,000 commercial and industrial establishments in its operational areas. It also supplies about 3.5 million kgs/day CNG through 256 CNG stations to about 0.75 million motor vehicles. For catering to its consumer base, MGL has laid down a network of about 5,630 km of steel and medium density polyethylene pipeline network.

Sandeep Gupta joins Shemaroo, other rejigs

Shemaroo Entertainment has appointed Sandeep Gupta as COO - Broadcasting Business and follows its strategic entry into the broadcast business and is expected to consolidate its entire broadcast offerings under Gupta. Shemaroo’s flagship Hindi GEC Shemaroo TV, and the Marathi movie channel Shemaroo MarathiBana, is expected to get a boost which will power its next growth phase under Gupta. He has moved over from his previous role at B4U Television Network India Limited, as the CFO & COO, for its Broadcasting Business in India. In his previous role, he not only scaled up but, turned around the company’s broadcasting business with improved market credibility and brand image and launched a few television channels too. In other internal top rejig, Subhash Somani, Deputy Vice President will now take additional charge of Shemaroo TV. He will oversee the entire business for Shemaroo TV - Content Production & Planning and Channel Distribution. While Vivek Koka, Assistant Vice President, who heads the Bollywood category will additionally hold the responsibility of its Marathi Movie channel ‘Shemaroo MarathiBana’, Yojana Bahalkar Bhave, Deputy General Manager, will lead the programming for this channel.