Re-boot on Opportunities and Risks

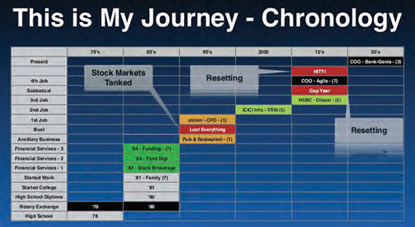

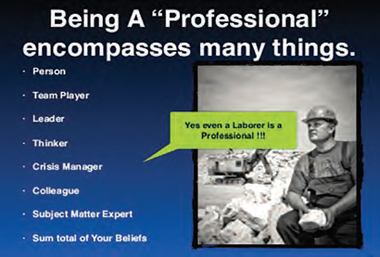

A son, a father, a spiritual disciple, a humane person, and a thorough professional is how Sumir Nagar, Chief Operating Officer at Bank-Genie Pte Ltd, describes himself. A blogger, a YouTube contributor, a passionate cyclist and cook is how he re-defines his persona. He believes that every individual can be a sum total of all that one believes in and function as a team player, a leader, a thinker, a crisis manager, a colleague and a friend, besides being the subject matter specialist all rolled into one individual. A career path that began within the framework of a family business in 1982 into metal fabrication, trading and exports saw multiple trajectories into the old world charm of the stockbroking ‘ring’ and gradually emerging as a specialist in digital transformation, treasury, risk, and wealth and fund management; also donning multiple hats into professional services, support, FR (financial requirements, fundraising), Legal, OPS and strategic sales. He is a mentor and guide to startups and as a board advisor and guest lecturer. He shares his campus to career journey Corporate Citizen captures a slice of Nagar’s triumphs and travails in this excerpt

Despite my reversals, I consider myself truly fortunate, I have lived and worked across four continents and travelled 40 countries in the last count including Singapore, Abu Dhabi, Chicago and London. I have visited some exotic locations, met and interacted with lots of different people. I have continued to be radical in thoughts and have taken risks, and what I have learnt is you can mitigate risk.

Many feathers in one cap

I do not have any fancy degrees and have played the role of a proprietor, of a partner, Managing Director and CFO. From CFO, I went back to being an Assistant Manager and then I grew to become a Global Head, Chief Operating Officer (COO) and a Director.

My work portfolio is a learning manifesto across domains in finance, operations, technology, in the vendor-related environment, in a bank-captive tech role, on the ‘sell’ side as well as the ‘buy’ side. My each role was different and came with its own demands, challenges and responsibilities. The lessons that I learnt have benefitted all my roles. I have absolutely no regrets in life because every adversity and challenge made me a much-much better professional.

As managing director of financial services, I developed multiple business lines such as stock brokerage, offshore fund management, financial syndication, wealth and fund management. The Chief Financial Officer role at Atcom Technologies combined my experiences with my skill set. Having lived and worked in four continents of the US, Europe, the Middle East and the Asia Pacific, I also served as a mentor and judge for an eBay Foundation startup initiative run by GriffinWorx, a US-based Social Enterprise. I am a guest lecturer on Data Analytics and Financial Services too.

I have not been fortunate enough to study higher. I don’t have any pedigree qualification apart from my B.Com but what you will see are the roles that I have played in the positions that I have held, have been fairly substantial.

I also took big risks and bet big in my career. I didn’t analyse sufficiently and just jumped into it (career situations) and I suffered, not only me, but my family also suffered.

Turning points

My first job was not out of college but much later. Don’t worry about being a late starter. There are people who start late in life and still succeed.

The turning point was in 1978-80 when I was selected for a Rotary Exchange programme to the U.S. The Rotary Club put us all in an ‘America on a Run’ tour and we visited 30 out of the 50 states by road; it was a month and a half on buses with 200 exchange students from all over the world. I met up with almost every culture. Every day we had a new seatmate, a new roommate. So, you got to know many people, develop bonds and friendships with them. I am in touch with some of them even today.

An alumnus of Sydenham College of Commerce and Economics, I completed Accounting and Economics Majors and decide to launch myself into stock brokerage.

"The professional journey is not going to be a smooth sail. You can overcome all challenges and there is nothing that you cannot do if you make up your mind"

A beginner’s risk

It was not a cakewalk as I traversed multiple risks scenarios for survival. I joined my father’s business in metal fabrication, and had the opportunity to travel to Cameroon, Egypt, Singapore and Malaysia to help with exports. But I soon realised that it was not my DNA, it was not really what I wanted to do. I had a mature chat with my dad who asked me to follow my heart. I decided to start with financial services, which always fascinated me. How money works, how it reaches from one hand to another hand. What attracts money?

Salvaging risks

Risk and reward are closely intertwined. I started with my family business, transitioned into financial services and the stock markets, moving on to Fund Management & Financial Syndication. I also dabbled into the food and hospitality sector which did not rake in returns. In the 1990s, I took a big risk and lost everything. I did not have a penny to my name. I was in a flux and really did not know what to do.

When I lost fortunes for the second time after spending seven years working for a startup, I walked away. I lost about $400,000 and it was ridiculous but had to re-set again. Here, began my tryst with the corporate world, and the process of job hunting for the first time in his life. It was frustrating but I never had to apply thereafter.

There was no stopping post my career leap with ICICI’s Treasury and Risk Management. I was the solutions specialist with the erstwhile ICICI Infotech, which became ICICI-3i Infotech. My most catapulting career run was with HSBC. Honestly, during the five years with HSBC across 76 odd countries, I had a remit which was across the globe and was a very enriching experience.

Family first

After jet-setting the world for 10 years between India and global work locations, I made a conscious move back to India to be with family. Effectively, my kids were growing up without a father. My wife was taking great care of them and became a solid foundation for their upbringing.

The Corporate Chronicle

"I burnt my fingers again when I dabbled in a restaurant business in Goa. Things were going well but I made a very fundamental mistake"

Embracing the professional path

I moved away from the family business and took the ‘easiest’ way into the stock markets as I did not have any MBA or CA qualifications. I got into the stock markets adding a small part of my own investments and family investments. I developed that into a huge business, doing institutional stock brokerage.

This was my entry into financial services. I was learning every day in a very unprofessional market. These were family-run stockbroker businesses some of whom had been educated overseas. I too had some great ideas and matured that into institutional stock brokerage akin to what was being run by SBI Mutual Fund, UTI, Bank of India Mutual Funds, and Jardine Fleming in those days.

I became the professional face for these institutions who were seeking a savvier persona as opposed to the traditional stockbroking community. But it ended up in a huge disaster because of the Harshad Mehta stock market scam, I was in the thick of it.

Rising from the stock market downfall

People became very greedy and had been advised to buy a lot of stocks and shares that we had recommended and kept telling them that something is wrong with the market. You got to get out of it, it is overheated so “sell, encash your profits”. But people somehow never envisaged that the market would tank, burnt themselves and lost a lot of money.

The move hit me very badly as I had acquired many of those stocks on behalf of clients. They did not pay me up and I was literally on the street. I had not speculated and had fronted for other people who did not honour their commitments. Back in the day, it must have been a hit of maybe INR 5-10 crores. Multiplying that by factoring inflation is like an INR 50-100 crore hit. It took me 10 years to recover. At the same time, I also embarked upon fund management and financial syndication.

I helped corporates acquire loans from financial institutions. You do their (corporates) calculations and present it to the financial institutions that was a huge learning experience. So, I went from dealing with individuals to dealing with financial institutions to dealing with corporates. I don’t think any B-school would have taught me that; I didn’t have the luxury, I had to learn on my feet.

Charting out unknown waters

I burnt my fingers again when I dabbled in a restaurant business in Goa. Things were going well but I made a very fundamental mistake. I was upbeat because my uncle is a leading hotelier who was with the Taj Group at that time. I took his advice, but unfortunately, the property where I was setting this up went into a huge legal dispute and again, I walked away after investing a lot of money.

The magic of networking and first job

My first job was as CFA and getting that first job was frustrating, uninspiring but a humbling experience. My wife used to say that I was always depressed and why I did not do something with my life. I did not know what to do next. I never worked for anybody in my life. How do I go and find a job for myself and that was a dilemma.

Luckily, being an alumnus of the reputed Sydenham College, Mumbai, I was able to reach out to co-alumnus Bobby Kanubhai Parikh, the founder of Bobby Parikh Associates and BMR Advisors. Parikh’s advice was to start with writing a CV. Not a milestone advice but an important one. This was the first time after I had finished my B. Com that I wrote a CV for myself it was nothing, just a few lines. But, I think, I managed to convey a gist of my experiences in a CV which was not electronic. It was the days of newspaper ads.

I scanned the newspapers every single day on relevant job adverts, and in one such wild shots, a headhunter recommended me for the post of CFO with Atco Weighing Scales. Every sweet or mithai shop in yesteryear Bombay had weighing scales manufactured by Atco and the owner was looking to move away from the ‘brick’ and mortar model to ‘click’ and mortar, set up a B2B exchange and that’s why he wanted a CFO. This was also the place that I had my first exposure to corporate email and had to up my learning curve as the company was using lotus notes package.

"An employee is useful so long as he or she contributes to its mission, vision and earnings. Stay relevant, and stay ahead of the curve"

Networking and net worth

The (Atco) job lasted only about a year because a lot of nasty things were going onsite and unfortunately, I had to bail out. It was also at the fag end of the tech-boom when jobs were very scarce, but I started job hunting again. After that first job that I had applied for, I never had to apply for a job ever again somebody was always looking for me, based on my skill and expertise.

In the second job hunt phase, a friend came to my aid. He was in charge of the computerisation of the Bombay Stock Exchange. He visited me and offered the job this friend was then the Joint President of ICICI InfoTech.

The (then) ICICI InfoTech honcho was humble enough to acknowledge that I was perhaps more qualified than him. He had said, “You need a job and I need somebody who has got your skills. Come work for me, I want you to build a treasury system, build trading algorithms, this is your DNA, and this is what you know backwards.”

The ICICI passage via Singapore, Abu Dhabi

I landed up as an Assistant Manager in ICICI InfoTech. But faced initial hiccups as I had never worked in technology. I understood the basics of computer programming, had done an Aptech Diploma but by no stretch of the imagination was I then capable of building a system or an ancillary to an existing system. For the first six months, all I did was try and write specs as to what the system should look like but had no clue about it. I was at loggerheads; I was screaming at the developers and the developers were frustrated with me. That is when this girl, came up front to ease the air between me and the department. Trusting her was my best decision. Listening to somebody who is very junior and just a developer did work well, six months later, we had what we wanted.

I spent the next five years with ICICI Info Tech and went up the ranks becoming Head of Product Strategy for Treasury and Risk Management Products. My international stints started at ICICI. At that point in time, ICICI was spread across the Asia Pacific, the Middle East and India and I was hired out of India and based out of Mumbai.

Next, came a prestigious assignment in Singapore with System Access which was acquired by SunGard. It was yet another learning curve. Although hired as an Assistant Manager, I was asked to study the Treasury Management System built by the tech company and write user documentation. My reaction was, “Is this demeaning or, what? And the then Joint President had said, “Either you lose your job or you end up doing this!” And he did a fantastic thing not only did he keep my salary alive in India but he also gave me compensation in Singapore.

I spent a year in Singapore writing user documentation. Today, my documentation skills are excellent. If there is somebody who can manipulate a word document, I know how to do it. All the tricks and tips and change to make sure that word works for you the way it should work.

In the five years at ICICI, I was also shunted to Abu Dhabi, as they had an implementation at the Abu Dhabi Investment Council, which is the Sheik’s financial services company. They needed an SME (subject matter expert), to build a few systems for them commodities and equities.

Willing the way forward via HSBC

ICICI already had a system and I was supposed to enhance and build a brokerage and an asset management system. Both my Singapore and Abu Dhabi assignments were extended to a year. It was during that time that an ex-colleague mentioned an opportunity in HSBC in their Global Technology centres in Pune. After six or seven rounds of interviews, I did meet the then CEO of HSBC but could not abandon my current job.

Within 15 days, I landed the job but had not yet finished with the Abu Dhabi ICICI assignment. I broached about the offer with ICICI and they agreed to release me after the three-months’ notice period. HSBC decided to onboard me whilst I served my notice period with ICICI. I would log into HSBC’s morning calls which were moved to accommodate my timings. By the time I took up the HSBC role, I already knew what was going on.

I began my five-year HSBC stint starting off in Pune, moving to Chicago and then London. I understood India, Singapore (Asia Pacific), the Middle East and then I started with Europe, the UK, North America, South America, Latin America, Australia, and New Zealand, which opened my eyes to the world. I worked with different cultures, technology and people, and learnt the way they react.

"Always validate with facts. People make promises based on other’s promises and if the foundation of promises is wrong then it will collapse and never get delivered"

Corporate wisdom

1. Accepting life’s twists and turns

Post HSBC, a short stint with a startup with a friend turned sour and I once again tapped into my strengthened network. My peer group is very senior I either studied with some or I play tennis or squash with them. That is when a friend who had joined Bank Genie contacted me. I believe there are no coincidences in life.

I was provided with a Singapore visa to meet the CEO of Bank-Genie and asked to join. But I was a little sceptical as I am used to certain levels of compensation. The CEO was very pragmatic and decided to work something out. That is how I joined Bank-Genie and it’s been three years since.

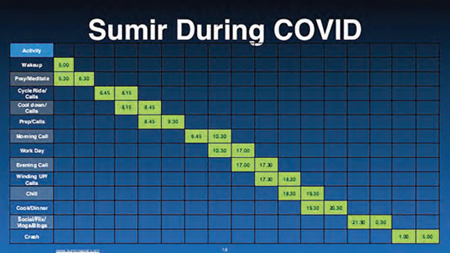

2. Haven in small towns

The mandate for the Genie job was that I had to be physically based in Mysuru. There is nothing wrong with working in small towns. I think they are great opportunities for a perfect work-life balance and less complicated, gives much more focused time. I have always lived in huge cities and said, I did not know how I was going to adjust myself. But I love it.

3. A company exists for profits alone

An employee is useful so long as he or she contributes to its mission, vision and earnings. Stay relevant, stay ahead of the curve, and hit the ground running, always prepare.

4. Playing the cultural card

One of the big learning in HSBC was dealing with diverse sets of people with different cultures. The Americans are strong at marketing, are much focused and know how to sell anything. The Brits are very structured, the Germans are precise, and the French are very bureaucratic. India and the Asia Pacific, including China and Hong Kong, are a risk-averse population because it is a regimented society. I have actually analysed why people work in a certain way, why cultures exist as the way they are. It is their DNA, how they have been structured, what are their histories as a nation, as a community and maybe, their religious leanings and beliefs too.

5. Be wary of mixing friendships with business

You should keep business separate and if you are going to work with friends, ensure that the financials are clear. Post HSBC, I joined hands with an ex-friend who had a new $billion startup and asked me to consult him. We agreed on a number and I started. But it was more than a full-time job. I spent seven years and walked away with a big hole in my pocket.

6. Respect the corporate food chain

Equate a corporate system to that of the biological food chain. In corporate life and even in your house, there is a food chain. You will report to people who will report to other people all the way to the top. When people who you are reporting to are tough with you, it is because there are others on top who are expecting results.

7. Trust but cautiously

Always validate with facts. People make promises based on other’s promises and if the foundation of promises is wrong then it will collapse and never get delivered.

8. Social media and communication

- No social media at work unless the profession demands it such as the digital sectors.

- Titles and designations do not mean anything.

- Do not be instantaneously reactive to sensitive mail.

- Write emails or letter from the heart make the written word more objective with less emotional overtures.

"Speak only when you can contribute. A person is invited to speak either for his valuable takeaways or contributions"

The passionate professional

The passionate professional9. Escalate matters

Do not escalate matters behind someone’s back. Send an email to the person concerned and copy his line manager and vice versa. Be transparent and don’t make it an issue it is not personal so focus on the topic. Don’t ever ask someone to do what you are not willing to do.

10. Always learn

Accept that there is always something that one does not know. What you don’t know will hurt you. I cannot show up for a meeting unprepared. Either because you have not read, you will not understand the context or either because you have not read, you cannot contribute anything.

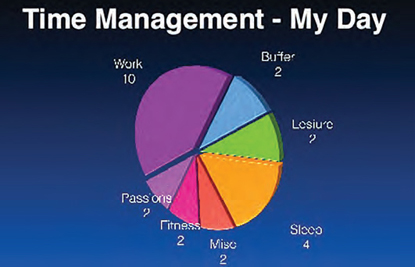

11. Time is money

Time invested is directly proportional to success and it is finite. Learn to distinguish between the urgent and the important - they are not the same thing. Your best friend in is your calendar. Believe in the power of a 24-hour day. Plan, schedule, and discipline; also, engage in follow-ups and responses. People want you to respond in a timely manner.

12. Be money savvy

In a startup, you cannot hire millions of people or pay the best possible salaries, so cost is paramount. In HSBC, I might have had somebody assist, here, I don’t, and so I need to do it myself.

13. Listen before you speak

Speak only when you can contribute. A person is invited to speak either for his valuable takeaways or contributions. If disagreement and agreeing to disagree are respectful, there is no harm in it. You don’t always have to say ‘yes’.

14. Not always a smooth ride

The professional journey is not going to be a smooth sail. You can overcome all challenges and there is nothing that you cannot do if you make up your mind.

15. Being a workaholic is a personal choice

I have no complaints and it’s my life and how I chose to live it.