For the Love of Finance!

He is charismatic and that reflects in his work too. With 30 years into his career, his resume is a clear testament to the fact that he has loved taking risks in his climb up the ladder of success. A close aide for many, a trusted financial advisor for his peers, and a mentor and comrade for colleagues and fresher’s alike, Neeraj Jain has indeed set up new standards for the role of Chief Financial Officer (CFO). Currently serving as the Vice President Finance and CFO J&J Medical India, Neeraj realized his love and calling for the realm of finance at an early age. And since then he never looked back. Corporate Citizen caught up with Neeraj at the recently concluded Finance Summit and Awards, Mumbai, organized by Morpheus Enterprises for a peek into the world of finance. Read on….

Give us a brief about your background.

I was born and raised in a very humble family in the small town of Hoshiarpur, Punjab, where I happened to spend my formative years. Our values were quite high as we lived in a close-knit family. I was also blessed with close friends who supported me through thick and thin. With time for everyone-family, relatives and friends, I was fortunate to get a good look at rural life. My father, who with Indian Railways as a civil engineer, taught me the first lesson of life-integrity. What also topped the list while growing up was a balanced ambition.

As soon as I finished my graduation in B.Com, I wasted no time in completing my CA. I burnt the midnight oil, and as I turned 21, I finished my CA with a good score. As my career was on track, I decided to settle down. My wife, Simmi, an Economics Honours graduate from St. Stephens, Delhi and a post-graduate in Economics from the Delhi School of Economics chose to become a homemaker to raise our two sons. Nishit, our elder son, now 27 years old, is a mechanical engineer from IIT Delhi but chose to work in the non-profit sector for five years. Currently, he is doing his MBA from Wharton in the US. Our younger son, Sanchit, a graduate from Columbia University, New York with a double major – in Economics and South Asian studies, works with a social development consulting organization. We have always cherished our dinner time conversations with our boys. This is the most satisfying part of the day for us when we exchange views ranging from value systems, economic issues, local societal issues to global issues. When I started my career, I coined my ambition to become a Chief Financial Officer (CFO) in a company. I achieved that at the age of 44 and the rest is a bonus.

‘Finance is one function which intertwines with every other function in a business. One gets a complete picture of all aspects of the business and often the finance people are looked up to for advice on most business strategies and actions. The best part is that a finance person’s disagreement with his manager is not frowned upon but seen with respect. A CFO has a fiduciary duty to its stakeholders that empowers her/him to act in an independent manner’

You have an astounding career background that ranges over three decades. Can you give us a brief insight as to how your career has fared so far?

Some of the non-negotiable were driven by my personal value systems and that defined the choice of the companies that I worked for. Management consulting in the early part of my career gave me insights into several industries, while working for HUL and later J&J helped me see my personal value systems aligned with the company.

In addition, what mattered to me was the fact that I enjoyed every day of my work and being part of a team that I loved to interact with. Finance became even more fun after running a business with full Profit and Loss (P&L) responsibility midway through my career, helping me see the impact it can make on every aspect of the business. During my career, I took some risks moving across diverse industries and different cultures.

However, my learning has been that in a career, the most important factor is the team, the people you work with and the impact you create in their lives. The choice is between having people who would like to work for you or having bosses that you would like to work for. I clearly preferred the former and I continuously measured myself against that.

Another important factor for the right career development – besides choosing the right company with the right value systems and being part of a quality team, is to keep re-prioritising-between money, growth, family responsibilities, personal time and most importantly, health. The rest fall in place.

‘My learning has been that in a career, the most important factor is the team, the people you work with and the impact you create in their lives. The choice is between having people who would like to work for you or having bosses that you would like to work for. I clearly preferred the former and I continuously measured myself against that’

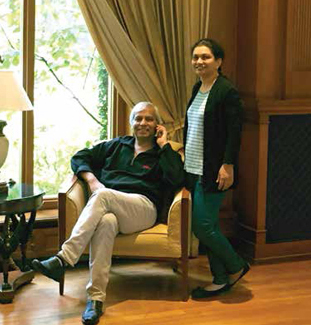

Neeraj Jain with his wife and sons, who he

Neeraj Jain with his wife and sons, who heconsiders his support system

From your first tryst with success at Hotel Siddharth as Assistant Financial Controller to currently serving as the Vice President Finance and CFO of J&J Medical India, can you talk about the various roles and designations you handled to date?

I started as a 21-year-old running a large finance department in a 5-star hotel in Delhi. It came with its own glamour but in a little over a year, I realized that I needed more challenge. Soon I interviewed with AF Ferguson, the best-known management consulting firm at that time and those were my real good formative years involving rich interaction with a very smart set of people. An itch to execute as opposed to advising meant that I had to hunt for a corporate role. That started my corporate journey at Hindustan Lever (called HUL now) which took me to six different places in India over 17 years, ranging from an internal audit role in Mumbai, followed by one as the finance head of a manufacturing plant in Punjab, moving on to become part of a large acquisition team by HUL and then completing the cycle with a role to lead revenue finance for North India.

Thereafter, an opportunity to start a joint venture between HUL and SC Johnson, a large privately held company in the US, took me to Pune where we built the company from scratch. The most interesting assignment was to follow thereafter, when I was told to head HUL’s seeds business in Hyderabad, offering me an opportunity to run the full P&L. Once we exited this business to a PE fund in the US, I moved as the finance and commercial head of exports business based out of Bengaluru. As the markets had opened up, one day I got a call to become the CFO of Johnson & Johnson Medical business in India.

Soon, I was back in Mumbai, this time with J&J. Supply Chain, international business, Asean markets finance, global and regional projects came along the way. Another defining moment came when I relocated to Singapore for an APAC supply chain finance head role for J&J’s large consumer business. After a while, for family reasons, I relocated back to Mumbai and came back full circle, becoming the CFO of J&J Medical India again. It has been a very satisfying career where I could work on my terms, live my values, work with a fantastic set of people and have fun at work.

Has Finance always been your calling? For many people Finance is boring, stressful and draining, how have you kept your interest alive in this field for so many years?

Yes. Finance has always fascinated me as it is one function which intertwines with every other function in a business. One gets a complete picture of all aspects of the business and often the finance people are looked up to for advice on most business strategies and actions. The best part is that a finance person’s disagreement with his manager is not frowned upon but seen with respect. A CFO has a fiduciary duty to its stakeholders that empowers her/him to act in an independent manner.

Also, as a finance person, one can work in very diverse industries as I did in my career and that is exciting. During my career, I learnt different businesses and cultures, new and evolving technologies, changing expectations from business leaders and also the way the function kept reinventing itself. One of the ways I kept my interest alive was to not get drowned into numbers and data but take quick decisions based on less than perfect data, hire people who were superior to me and empower them fully. That helped me build a smart team wherever I worked.

Can you explain to us what the term Chief Financial Officer means? Tell us how a day of a CFO looks like.

A CFO is someone who partners with the business to drive profitable and compliant growth while protecting the interest of all stakeholders. A typical day in a CFO’s life can be divided into three distinct areas: strategic, operational and people.

Strategic area: It would include giving advice on business strategy, reviewing business performance-based insights, evaluating new ways of doing things and acting as a sounding board for almost every leader in the company. That typically takes a big portion of the day.

Operational role: It relates to providing approvals, setting up processes, ensuring compliance, managing efficiencies, ensuring availability of funds and managing stakeholders.

People: The third area which is most important but often neglected is around people: effective delegation, empowerment, training, hiring and rotating talent, creating succession plans for all key roles and keeping the finance team engaged and motivated. Without the third, the other two will suffer and be sub-optimal.

You also serve as the Vice President of Supply Chain and Strategic Distribution. Can you tell us the importance of supply chain management?

A supply chain is at the heart of the P&L. Procurement of stock and non stock items are the biggest cost items in a typical P&L. Right procurement and optimum inventory planned and distributed through the right channel can be a game-changer. A delicate balance is required between being efficient and not-to-miss sales. With technology and changing tax regimes (e.g. GST), the supply chain can help optimize working capital in a big way, thus releasing cash into the system.

What according to you is the right distribution strategy that affects logistics performance?

This will depend upon the nature of the business. The intent should be to have the product available at the time of the consumer’s demand. To enable this, one can have a conventional distributor model which is still relevant in India due to the fragmented markets, last-mile connectivity requirements, language and cultural issues and relevant local expertise needed.

For large customers, key account management is important as these customers like to deal directly. Finally, the e-commerce model is gaining momentum very quickly and for products that are not regulated otherwise, it is an effective channel. However, one needs to strike a balance between e-commerce and conventional distributor led system to avoid conflicts and price wars.

From a warehousing perspective, while post GST, it is very attractive to have a single common warehouse in the centre of India, but we, as a country, are still not ready with the best road infrastructure to reach everywhere in time, and therefore the need to keep a mother warehouse and several JIT warehouses in different regions cannot be overlooked.

How has the technology boom revolutionized the world of supply chain and distribution? Can you tell us about the latest software used?

SAP remains a favorite ERP solution that encompasses finance and supply chain. Technology has helped us get insights into secondary sales on a continuous basis and this can easily be achieved by having a customized CRM solution depending upon the size of the business.

‘I urge youngsters to learn all aspects of the business to be successful in finance. Be aware of the changing technological landscape around you and adapt quickly. Take risks in your career and experience different cultures. Never compromise on values-it is just not worth it. Chase fun and joy at work, not promotions as those, will automatically come’

Over the years, Neeraj and his wife, Simmi,

Over the years, Neeraj and his wife, Simmi,have derived a perfect balance between

work and professional life

What are the shining highlights of your career?

My biggest achievement has been the number of people who have worked with me and have achieved CXO roles. This includes Managing Directors in large companies in/outside India, several Senior Directors/Directors in finance and supply chain. There is no bigger satisfaction than seeing your team members achieve their dreams. Most people who worked for me have stayed with me all through. Rarely have I lost people from my team and I count this as a key achievement.

The functioning of my groups in the last three decades in an environment without any hierarchy is also a special achievement that I like to count. On the professional side, becoming a Chartered Accountant when I was still below 21 years and becoming a CFO of an MNC is something that I cherish. Having lived and challenged when needed and without any fear to ensure 100 per cent compliance is dear to me.

You have built quite a friendly environment for the millennials working in the company. How do you bridge the gap in age, thinking and perception?

Firstly, by acknowledging that they are as qualified as I am, and in several areas, they are better (technology, multi-tasking, awareness about social issues, global knowledge). Some of the initiatives that have helped include removing all hierarchical barriers, providing flexible working hours with more focus on output than the input, quicker job rotation (18-24 months on a role), open houses, regular fun events, letting them lead or be part of the regional projects and helping them present to the board, quick recognition of the work done and helping them pursue their passions outside work.

Other than working, what keeps you busy?

Regular vacations with family, wildlife tourism, amateur photography, angel investing, dinner time conversations on social issues, non-fiction reading, Bollywood music and movies.

What’s your philosophy in life?

Eternal optimism, high level of personal and professional integrity, conviction in doing the right things without any fear, not chasing money that cannot be spent in one’s lifetime as the next-gen does not need your money, striking a balance between life and work as work can at best be a part of life, and remaining stress free by constantly looking at how many people aspire to be where you are as against thinking about lost opportunities in life.

Any word of advice for fresher’s entering the world of finance?

I urge youngsters to learn all aspects of the business to be successful in finance. Be aware of the changing technological landscape around you and adapt quickly. Take risks in your career and experience different cultures. Never compromise on values-it is just not worth it. Chase fun and joy at work, not promotions, as those, will automatically come. Early engagement and networking with senior leaders are also important. Ask questions if you feel uncomfortable and shout for help if you need. Try and move across several finance roles in order to learn even if some of these are not as interesting.