CORPORATE CITIZEN CLAPS FOR THE UNIQUE PURSUIT OF JEETENDRA SINGH, A 40-YEAR-OLD SECURITY GUARD FROM SURAT, WHO HAS DONE MORE THAN LIP SERVICE, IN HAILING THE MARTYRDOM OF OUR SOLDIERS - BY WRITING LETTERS AND EXPRESSING HIS GRATITUDE TO THE BEREAVED FAMILIES

“I started writing letters to families of martyrs after 1999 Kargil war and till date have written over 4000 letters. I have information and addresses of nearly 38,000 army personnel’s families. My objective is to offer my gratitude to the service their sons, husbands and fathers did to the people of India like me,” he said. Jitendra, originally from Rajasthan’s Kutkheda district hails from a fauji family too wherein generations of his family have served the Indian Army since the Second World War. He, however, missed joining the force; failing the mandatory physical test by just one centimeter in fulfilling chest and height requirements. “I then decided to wear the uniform even if it meant becoming staff of a private security company.” Despite his request to allow him access to more bereaved martyred families, the Army headquarters in New Delhi, has understandably turned him down as per said Army protocol. He has since resorted to newspapers clips and other sources in the media to collect information and addresses of the families. “I just want to tell their families that there is one man in Gujarat who thinks of their well-being,” he said. Despite his Rs.10, 400, as salary and deteriorating eyesight owing to writing letters of ‘gratitude’ in dimly lit areas and a family to take care of, he has not once stopped buying postcards since the Kargil War to the recent Pulwama attacks. “When I started, out, one postcard would cost me around Rs.15 paise and in the last 18 years or so, the cost of one postcard has reached Rs.50 paise. I buy postcards every month.” Despite his poor financial means, he did make efforts to raise funds for the families of the most recent Phulwama terror attacks, while refusing any sort of financial assistance for himself. A true fauji, Jitendra also paid tribute by naming his own son after Hardeep Singh, a martyr from Karnal (Haryana) who sacrificed his life in 2003 fighting terrorists in Jammu and Kashmir. Salute to the ‘spirit’ of this ‘soldier without uniform’.

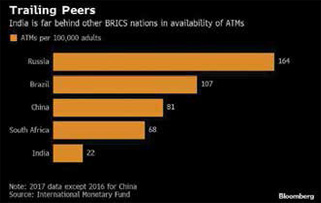

CORPORATE CITIZEN SLAPS THE SCENARIO WHICH HAS SEEN THE SHRINKAGE IN THE NUMBER OF AUTOMATED TELLER MACHINES (ATMS) IN THE COUNTRY IN THE PAST TWO YEARS DESPITE AN INCREASE IN TRANSACTIONS

Recent Reserve Bank of India (RBI) figures show that India has the fewest ATMs per 100,000 people among BRICS nations, as per International Monetary Fund (IMF) records. This decrease is likely to continue as banks and ATM operators struggle to absorb the cost of equipment and software upgrades that have been mandated by the RBI last year for enhanced security. Despite the attempt to increases financial inclusion for all, cash continues to be the ‘King’ post the demonetization bid in the past three years. ‘Declining numbers of ATMs will impact a large segment of the population, especially those who are socio-economically at the bottom of the pyramid,’’ said Rustom Irani, managing director at Hitachi Payment Services Pvt. Ltd., a provider of the machines. With high security costs on an uphill, ATM operators are finding it monetarily difficult to sustain running ATMs as the fees that they rely on for their revenue remain low. Besides, increasing this fee is impossible without the approval of an industry committee. Also, increasing ATM usage fee might become unpopular with consumers too. Currently, ATM operators (banks as well as third parties), charge Rs.15 as interchange fee to the lender whose debit or credit card gets used for cash withdrawals. Branch rationalization by some public sector lenders has also led to the decline in ATM numbers. For SBI, one in two ATMs are located at bank branches. A managing director at SBI, Dinesh Kumar Khara said, “Banks will rely less on branches in the future as digitization changes how the sector operates. With the popularity of Mobile banking, the decline in the number of ATMs is expected to go down further. The decline in physical availability of ATMs is sure strengthening Net banking in India – home to one of the world’s largest millennial and Generation XYZ populations. The number of mobile banking transactions grew 65 times in the past 5 years alone. However as per Ashutosh Khajuria, a chief financial officer at Federal Bank Ltd., “It’s too early to write an obituary on ATMs but it’s certainly declining.’’

by Sangeeta Ghosh Dastidar