India’s fiscal scene has never been better in 300 years

Infosys co-founder N R Narayana Murthy said India has for the first time in 300 years an economic environment that breeds confidence and optimism that its poverty can be eliminated.

“For the first time in 300 years, we have an economic environment that engenders confidence that we can indeed overcome our poverty and create a better future for every Indian,” said Murthy, addressing the fourth convocation function of the Madan Mohan Malaviya University of Technology (MMMUT) at Gorakhpur.

“If we try hard, we can wipe the tears off the eyes of the poorest of the poor child, as Mahatma Gandhi wanted,” said Murthy, addressing the gathering that comprised Uttar Pradesh Governor, Anandiben Patel, Chief Minister, Yogi Adityanath, besides MMMUT Vice Chancellor, Sri Niwas Singh, dozens of university professors and hundreds of students.

Adetya V Chopra joins Bafna Group as Group Head hr

Bafna Group has appointed Adetya Chopra as the Group Head HR. Bafna Group believes that Adetya will create an employee-oriented, high-performance culture that emphasises empowerment, quality, productivity and standards to ensure goal attainment and to carry out recruitment and ongoing developments to assure the formation of a superior workforce. Chopra has 16 years of rich professional experience. He has led L&D teams of prestigious companies, such as NIIT, Wipro and Synergy. Chopra worked as the CEO of Veritas Human Capital Consulting Pvt. Ltd. for more than five years. Veritas was the winner of the prestigious ‘Asia Pacific Leader Award for Talent Management & OD’ during October 2013.

Wipro buyback: Premji sells shares

Azim Premji, founder of India’s third-largest IT services company Wipro, and his other group entities sold about 22.46 crore shares worth over Rs.7,300 crore during the Wipro buyback offer that closed in August. In a regulatory filing, Wipro said it had bought back 32.3 crore equity shares at Rs.325 a share. The total amount utilised under the buyback was Rs.10,499.99 crore.

Before the buyback, the promoter and group companies’ shareholding stood at 73.83 per cent; post buyback, this went up to 74.04 per cent. According to the filings, about 6.12 crore shares from Azim Premji Partner representing Zash Traders, 6.03 crore shares from Azim Premji Partner representing Prazim Traders and 5.02 crore shares from Azim Premji Partner representing Hasham Traders, were accepted under the buyback. Earlier this year, Premji had announced that he is pledging 67 per cent of his total shares to Azim Premji Foundation.

Rajiv Kumar named Md of Microsoft india, R&D

Microsoft appointed Rajiv Kumar as managing director of Microsoft India (R&D) Pvt Ltd (MIRPL). Currently, corporate Vice President of Microsoft’s Experiences and Devices (E+D) Group, Kumar is taking on this added responsibility from Anil Bhansali, who held this role for the last six years. Bhansali will continue as the corporate Vice President of Cloud & Enterprise and will be relocating to Redmond, USA. Kumar has a track record of strong people leadership, innovation and sharp business acumen in his 27-year long career at Microsoft. Over the years, he has innovated a variety of products and built large world-class engineering organisations rooted in the foundation of a strong culture of Microsoft, according to a company statement. Among Kumar’s recent key contributions to Microsoft are Kaizala (an enterprise productivity chat app) and bootstrapping campus hiring programme in India, resulting in Microsoft hiring the best talent from premier engineering colleges in India.

Ankiti Bose, first Indian woman to cofound a billion-dollar fashion startup

Meet Ankiti Bose, she is 27, a fashion junkie and on course to become the first Indian woman to co-found a $1 billion startup. Bose is CEO of online fashion marketplace, Zilingo. She started the business with her neighbour, Dhruv Kapoor, back in 2015, when she was just 23, working as an analyst at Sequoia India. Kapoor, then 24, was a software engineer at gaming studio Kiwi Inc. “We were neighbours. Literally, it was unit 302 and 303 and we had never met. But my flatmate invited his flatmate over for a beer and neither of us was actually supposed to be there,” she said. After that casual meeting in Bengaluru, they were quick to realise they had complementary skills and similar ambitions to build their own startup. Four months later they had quit their jobs, and each had put in their $30,000 in savings to found Zilingo. The online platform allows small merchants in Southeast Asia to build scale.

Today, the company says its valuation is approaching $1 billion. While it has an e-commerce portal for consumers, the majority of Zilingo’s revenue comes from providing B2B services. Say, for instance, you are selling scarves at Bangkok’s Chatuchak weekend market. By signing up with Zilingo, you get help with procurement, so you can buy your stock at a lower price. You get advice on the kind of designs that are trending, based on data analytics. You get financial services, such as loans and insurance, to expand your business. And you get the tech support that enables you to start selling your scarves online. In four short years, Zilingo has more than seven million active users. Ask her about her vision for Zilingo, and she says, “I want to take this company from Asia to the world. I definitely think that we can be a global company.”

Indifi Technologies Appoints Maninder Singh Juneja on its Board of Directors

Indifi Technologies appointed Maninder Singh Juneja in its Board of Directors. Juneja has been actively involved in determining the overall growth strategies and other broader goals of the firm as its Strategic Advisor since 2017. This unanimous decision was taken to further leverage the veteran’s 25+ years of domain experience in overseeing the day-to-day activities of and directing the policies and future course of action for Indifi.

An experienced managing director with a demonstrated history of working in the banking and finance domain, Juneja is the MD of True North Managers LLP (formerly known as India Value Fund Advisors) at present. Prior to this, he worked in ICICI Bank for 15+ years, handling various responsibilities across roles including that of Retail Assets Head, Retail Risk Manager, and Retail Business Head, to name a few.

An IIM Lucknow alumnus, Juneja has diverse work experience with industry acumen in management, business development and strategy, retail banking, credit analysis and financial risk, etc. Considering how Indifi is looking to delve deeper in the existing verticals, explore newer verticals, enhance its technological framework and introduce new products, appointing a seasoned player like Juneja marks an integral step taken towards realising these growth plans.

Ishita Medhekar is new HR head at Metropolis Healthcare

Metropolis Healthcare has appointed Ishita Medhekar as Head HR. She will lead the global HR team of the diagnostic company, and be responsible for driving growth through transformational HR interventions, supporting the organisation’s development and steering cultural-change initiatives and strategies. A seasoned HR professional, with over 20 years of experience, Medhekar spent the last 15 years in the telecom, consultancy and pharma sectors, focussing on strategy and system designing and operations. Medhekar makes the move from Sterlite Power, where she was the Head-HR. She has also had successful stints with Bharti Airtel, Avaya Global Connect, AF Ferguson & Co. and JK Drugs and Pharmaceuticals. Vijender Singh, Chief Executive Officer, Metropolis Healthcare, expressed confidence in Medhekar’s diverse and rich experience. He believes that her in-depth knowledge of HR strategy, processes, design and business partnering, will be an asset to the organisation in its journey forward. Metropolis Healthcare has a widespread presence across 19 states in India.

Lendingkart bolsters its leadership with three senior appointments

Lendingkart has announced the appointment of three new senior executives to strengthen the company’s vision of financial inclusion for everyone. With an aim to further streamline its business, Lendingkart has expanded its leadership team with Sudeep Bhatia as its Group CFO, Bratindra Sanyal as SVP – HR and Deepesh Goel who joins as VP – New Initiatives & Strategy. Bhatia is a senior BFSI business leader with over 20 years of experience in business development and strategy, corporate finance, investor relations, financial control, taxation and regulatory matters. A qualified chartered accountant, cost accountant and certified public accountant, Bhatia has held several key leadership positions with large conglomerates, banks and financial institutions such as Macquarie, Tata Capital, Citi Financial and GE Capital across the world.

Bringing over 15 years of industry experience, Sanyal has successfully led the HR function across industries and geographies such as India, China, Philippines, Europe and America. Prior to Lendingkart, Sanyal worked with JP Morgan Chase as Head HR, as well as HSBC, Genpact and Tata – AIG Life Insurance Co Ltd. in varying capacities. Before joining Lendingkart, Goel was amongst the core founding team members of CoinTribe Technologies. A seasoned management consultant with over eleven years of financial services experience, Goel has worked with leading consultants including BCG, EY and Deloitte on multiple local and international assignment for banks / NBFCs / AMCs etc. focusing on digital transformation, new market entry, new product development, business process engineering and developing thought leadership.

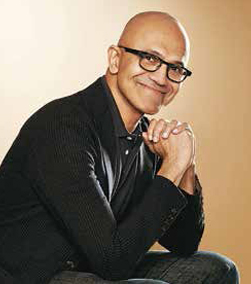

Microsoft CEO Satya Nadella sold millions of dollars in stock

Microsoft stock is surging this year and CEO Satya Nadella has been selling millions of dollars of shares. Microsoft stock has rocketed 36.9% year to date, already topping last year’s 18.7% rise. By comparison, the S&P 500 has risen 18.8% so far this year, compared with a 6.2% drop in 2018. Shares of the software giant have more room to rise, according to one analyst, who sees Microsoft stock hitting $160 on the strength of its cloud-computing business. That means the biggest US-traded company is currently the only entity with a market capitalisation of more than $1 trillion— could get even bigger.

Nadella has sold $43.8 million in stock so far this year, a total of 382,637 shares. His latest sale was on September 4, when he sold 99,837 Microsoft shares for $13.7 million, an average per-share price of $137.20. He now owns 1.11 million Microsoft shares, according to a form he filed with the Securities and Exchange Commission. Nadella sells stock through planned transactions, which are automatically executed when preset parameters, including price and volume, are met. Such transactions are meant to remove the appearance of bias or knowledge of material non-public information.

Paytm appoints two ex-Google executives

Paytm has announced the expansion of its leadership team with two former Google executives, Praveen Sharma and Ankit Sinha. Praveen Sharma has been appointed as Senior Vice President, Ad Business and will be responsible for leading the group’s foray into advertising across Paytm businesses. Ankit Sinha has joined as Vice President, Paytm AI Cloud and will be responsible for productisation of the best of Paytm’s technology stack. Both of them will report directly to Paytm Founder and CEO Vijay Shekhar Sharma.

Praveen Sharma comes from Google where he spent the last nine years in leadership roles across India and APAC. Most recently, he was based in Singapore, responsible for driving Google’s performance media across the Asia Pacific region. This was preceded by his stint in India where he led Google India’s YouTube and Display sales organisation. Leading up to Google, Praveen held several senior-level positions across some of the major advertising groups like Madison and Group M. Ankit Sinha comes with 15 years of professional experience. Previously, he worked as Regional Business Lead at Google Cloud for six years, primarily in the cloud sales and enterprise partnerships role. Prior to Google, he was part of SAP for seven years, building the SMBs focused partner programme.

Uber pays out $6,500 bounty for hacking bug discovered by indian researcher

NASDAQ-listed ride-hailing giant, Uber, has recently fixed a hacking bug found by Indian cybersecurity researcher Anand Prakash and paid him a bounty of $6,500. Prakash told media persons that the bug allowed hackers to log into anyone’s Uber account.

After receiving permission from Uber to disclose the bug under the responsible disclosure policy, Prakash, founder of AppSecure and a Forbes 30 Under 30 honouree, explained that the bug was an account takeover vulnerability on Uber that allowed attackers to take over any other user’s Uber account, including those of partners and Uber Eats users. The bug supplied user UUID in the API request and use the leaked token in the response to hijack accounts.