Streaming, Stories and Scale

How Indian artists are marketing music in the digital age

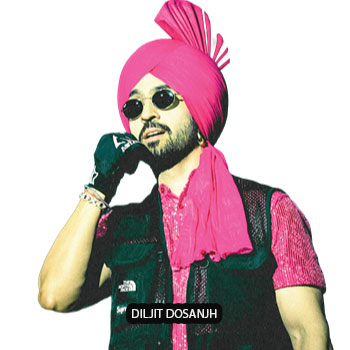

When Diljit Dosanjh walked onto the Coachella stage, he wasn’t just playing to thousands; he was carrying Punjab with him. That moment proved a sound once considered ‘regional’ could stand tall on a global stage. It signalled a fundamental shift: songs no longer travel solely through films and radio. They now ride algorithms, short-form videos, and the phones in our pockets.

India’s music economy long presented a paradox: a billion-plus audience with revenues lagging behind global peers. Listeners streamed endlessly on YouTube, but only few paid for it. That narrative is changing. The International Federation of the Phonographic Industry (IFPI) Global Music Report 2024, notes that while overall revenues dipped slightly, paid subscribers rose to about 10.5 million. This modest number signals a crucial cultural shift—listeners are warming to subscriptions.

YouTube remains India’s default jukebox, with over 450 million users. Its blend of music videos and shorts makes it both a library and a laboratory

Algorithms as gatekeepers

This evolution forces artists and labels to rethink marketing. Success depends on juggling two arenas. On one side, are platforms like Spotify and YouTube, where algorithms decide who gets heard. On the other, are human spaces like Instagram reels, WhatsApp groups, and the gig circuit, where music becomes conversation. The smartest players court both — the data that drives discovery and the stories that make listeners stay.

Spotify’s tools like discovery mode, showcase and marquee, let artists promote tracks to targeted audiences. But, they only amplify what already resonates. Prateek Kuhad’s ballads, saved and replayed by loyal fans, are a case in point—when music has emotional pull, these campaigns multiply its reach. Managers now use these tools like digital ads—test smaller samples, measure returns and scale, only if the needle moves.

Regional beats and music with national reach, are rewriting the charts. Dosanjh’s Punjabi hits challenge Bollywood, while Tamil and Telugu tracks gain national currency. PwC’s Media and Entertainment Outlook 2023 noted, vernacular genres are key drivers of India’s streaming growth. The business lesson is clear— authenticity sells better than translation.

YouTube remains India’s default jukebox, with over 450 million users. Its blend of music videos and shorts makes it both a library and a laboratory. Indie band When Chai Met Toast, tests choruses on shorts before full campaigns. If fifteen seconds of a hook travels, labels know they have a hit.

Even WhatsApp is the key—when Meta launched channels, artists adopted it to bypass crowded feeds. Producer-singer Ritviz uses his channel for exclusive snippets and tours, building a community that feels closer than any ad campaign.

From songs to product launches

The modern release cycle is a product launch. A month out, snippets seed on reels; two weeks out, labels pitch editors and set regional spends; release week brings saturation via lyric videos and WhatsApp blasts. After launch, data dictates geography—if Hyderabad streams surge, efforts pivot south.

The road ahead is promising but uneven. Subscriptions are rising steadily, and each uptick translates into real revenue. Platforms will sharpen monetisation, while artists diversify through superfans, live shows and brand ties. For investors, the opportunity lies in segmentation, wherein India’s growth will come from vernacular markets and hyper-local strategies.

Ultimately, algorithms grant the first listen, but culture guarantees the hundredth. Dosanjh’s swagger, Kuhad’s ballads, and Ritviz’s energy underline one point—authenticity is the currency on which Indian music business can bank on. Finally, the business is starting to sound as big as the passion.

The numbers behind India’s streaming boom

- ₹2,000 crore — Estimated size of India’s recorded music industry (PwC, 2023)

- 10.5 million — Paying music subscribers in India (IFPI, 2024)

- 450 million plus — YouTube users in India (Statista, 2023)

- Top growth driver— Punjabi, Tamil and Telugu genres now competing with Bollywood on national charts

- Platforms to watch — Spotify discovery mode, YouTube shorts, WhatsApp channels