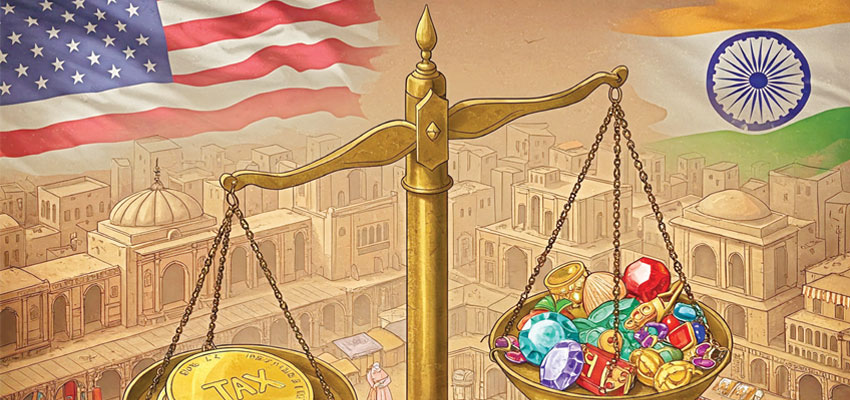

Impact of Trump’s Tariff on India

"The U.S. President Donald Trump, recently announced sweeping tariffs against over 180 countries, including a 26 per cent tariff on exports from India. Bound to bring global trade disruptions, Corporate Citizen speaks to corporate leaders across sectors, about its impact on vital sectors. Do they see this disruption as an opportunity for India? Will it be a boon or bane for India? "

Turning Trump challenges into opportunities

ANKITA SINGH,

chief people officer and board of

director, CIGNEX and Relevance Lab

Trump's tariffs—26% on Indian exports and 25% on foreign autos—are hitting hard. But, history shows the most successful companies don't just endure disruptions; they use them to transform. This is our moment to rethink how we operate.

We're already seeing 75% of businesses retraining staff and 60% implementing AI (Gartner data)—not just to cut costs, but to work smarter. That's exactly what we're doing, doubling down on upskilling, automating routine tasks, and building a workforce that thrives on change. Our people are our biggest strength.

By investing in their development—giving them new skills, better tools and real support—we're not just solving today's problems, we're creating an organisation that can handle whatever comes next. The path forward? Less complaining, more adapting.

Fewer comparisons, more collaborations. When we focus on controlling what we can—our mindset, our agility, our willingness to evolve—we don't just survive tough times, we emerge stronger, more innovative, and better prepared for the future.

Let's use this challenge as our catalyst. The companies that will lead tomorrow aren't those that avoided disruption, but those that learned to harness it. That's who we're becoming.

India can mitigate Trump’s tariff impact

AMAR KULKARNI,

global product evangelist,

PolyWorks Software

The newly imposed U.S. tariffs on Indian exports will strain trade relations, but India can mitigate the impact. While sectors like steel, aluminium and automobiles, may see higher costs, such challenges often spur diplomatic negotiations and strategic realignments.

India’s vast domestic market provides a cushion, encouraging businesses to prioritise local demand. For export-heavy industries, the government could expand Production-Linked Incentives (PLI) to soften the blow.

Additionally, India’s active Free Trade Agreements (FTAs) with the UAE, Australia, Europe and ASEAN nations, may help diversify exports, reducing dependence on the U.S. Some sectors still benefit from lower tariffs than competitors, offering a potential edge.

Rather than a defensive approach, India should seize this moment to reposition exports, explore new markets, and enhance supply chain resilience.

While short-term disruptions are inevitable, the long-term response will determine whether India converts this challenge into an opportunity, strategic policy adjustments and agile trade diplomacy will be the key.

The coming months will reveal whether India can leverage this situation to its advantage, but proactive measures today will shape tomorrow’s outcomes.

Loss of market share and slower purchasing trends

MANU SINGHAL,

managing director, R K Singhal Exports

The 26% increase in the U.S. tariffs is a major issue for Indian exporters, with immediate impacts visible already. Buyers are cautious, with many orders on hold or reduced in size, due to concerns over rising product costs due to the tariff increase.

This hike will severely impact the profitability of the exporters, as U.S. companies like Walmart buy products in huge volumes, and 26% is a big deal for such quantities.

China, known for cheaper products, is a strong alternative for buyers, further complicating the situation for India. Additionally, due to recessionary trends, U.S.

inventory levels are already low, and demand for decorative items like handicrafts remains slow. As a result, India faces both a loss of market share and slower purchasing trends.

Respect decision to keep the Pharma sector out of the cross tarif

SUSHIL SURI,

chairman and managing director,

Morepen Laboratories Ltd.

We gracefully accept and respect the Trump Government’s decision to keep the Pharma sector out of the cross tariffs, on the expected lines. We have a very diversified business, both in terms of products and geographical distribution.

Morepen exports span over 82 countries, of which exports to the U.S. markets account for only 6% of the company’s revenue, which we hope to increase gradually. India is the largest generic supplier to the U.S., and we remain committed to upholding quality and competitive pricing. We have no immediate plans to cut exposure to the U.S., since our facilities are approved by the United States Food and Drug Administration (USFDA), and it is not easy to find new FDA (Food and Drug Administration) approved facilities overnight. We are competitively priced and reckon that the U.S.

customers will still be in a better position to buy from India even if they are compelled to pay small tariffs in the future. Although, the entry barrier is related to USFDA-approved plants, they either buy from India or China, as Europe is very costly anyway.

Will hit Indian jewellery exporters

SAURABH GADGIL,

chairman and managing director,

PNG Jewellers

The tariff imposed by the Trump administration will hit Indian jewellery exporters. Initial indications suggest an increase to 10% of import duty in the U.S. from the current 5.5%.

As far as domestic consumption of gold is concerned, neither is India an importer of gold nor jewellery from the U.S., therefore, as far as our business is concerned, we will not face any impact.

On the contrary, the U.S. imports several goods and commodities from Asia, which will invariably become more expensive now. Therefore, there is still a catch in the Trump administration’s objective of bringing in more dollars to reduce its debt, as the prices of the same goods, which will now become more expensive, and lead to inflation in the U.S., further slowing down the economy.

More importantly, the policy will affect the entire world, and not just the U.S. Therefore, reciprocal reactions are awaited, and Indian players need to see how this unfolds in the days to come.

The tariffs have created a temporary setback

SANYOGEETA

RANANAWARE,

founder, Privacient

The Trump tariffs threw a wrench into our U.S. expansion plans, no doubt. We had been building momentum over time, with several US-based clients showing strong interest in our solutions. Now, the economic uncertainty has made them more cautious.

While our core offering isn't directly impacted by the tariffs on goods, the overall market sentiment definitely matters. When the U.S. businesses are worried about economic headwinds, they tend to tighten their budgets, and that includes investments in new technologies like ours. We've seen some deals delayed, and that's concerning for a startup in its growth phase.

However, I remain optimistic. Privacy is a global concern, and the U.S. market remains crucial for us. We believe that the increasing regulatory pressure on data privacy in the U.S., combined with the growing awareness among consumers, will ultimately drive demand for our solutions.

We're doubling down on our marketing efforts, highlighting the efficiencies Privacient can bring into data privacy programs. While the tariffs have created a temporary setback, the underlying need for robust data privacy solutions isn't going away.

Negative impact and opportunity

SHEETAL

JAIN,

founder and CEO,

Luxe Analytics

The significance of tariff on India, 27% is less as compared to what the U.S. has imposed on other exporting countries.

Tariff on jewellery will have negative impact on jewellery exporters, while in apparel sector, greater tariffs on Chinese and Bangladeshi exports create opportunity for Indian textile manufacturers to increase exports to the U.S. Overall, Trump tariff could benefit India by attracting investments in key industries and increasing its role in global supply chains.