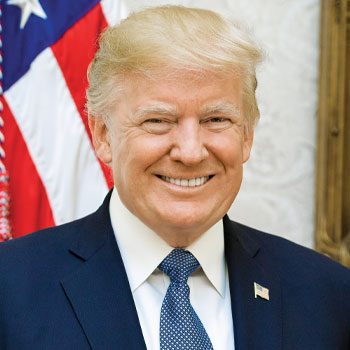

What Trump 2.0 Means For India

Trump’s victory is a mixed bag of challenges and opportunities for India. Or, will it mark a promising chapter in the deep-rooted US-India partnership, with substantial potential for growth in trade, skilled workforce demand, and collaborative economic development

Now, when it is clear that Donald Trump will come back as the 47th President of The United States, India will find itself in both, lose- some and gain-some situation. Let us start from the advantages India will be having. The biggest among them will be the fact that both Trump and Modi enjoy a very good bonding among themselves which is set to bode well for India-US trade.

Yet another good news is presence of a woman of Indian origin in the high-profile Trump Team, Usha Vance. Her husband’s meteoric rise to the White House second-in-line comes at a time when Indian Americans are a growing political force. Hailing from the Vadluru village of the coastal Andhra Pradesh, Usha wears many hats — daughter of immigrants, Yale graduate, lawyer, wife and mother of three.

Things like the potential for increased tariffs, H-1B restrictions, and a strong dollar could bring short-term volatility. But it also presents India with long term incentives to expand its manufacturing, diversify export markets, and enhance economic self-reliance.

In fact, Trump’s return marks a promising chapter in the deep-rooted US-India partnership, with substantial potential for growth in trade, skilled workforce demand, and collaborative economic development. The US has become one of India’s foremost investors, with significant contributions across sectors like technology, infrastructure, renewable energy, and manufacturing, fuelling India’s development, creating jobs, and positioning India as a competitive global player.

A key area of expansion lies in the growth of Global Capability Centres (GCCs), with numerous US companies eager to tap into India’s skilled labour pool, setting the stage for job creation and reinforcing India’s standing as a global talent hub. The robust bilateral trade between US and India, reaching $118 billion in goods and services exchanged in FY 2023-24, will remain a key focus.

US exports to India saw an 84 per cent increase to $39,817.4 million in 2021 from $22,105.7 million in 2012, while imports from India surged by 81 per cent to $73,308.2 million, from $40,512.6 million over the same period. Notably, trade between the two countries grew robustly from 2017 to 2021 during Trump’s previous presidency.

The focal points of Trump 2.0, as per a study by SBI’s internal economists, should rotate or revolve around the stated economic policies, tax to tariff to jobs and war on prices while taking a tough stand on issues like illegal migrations and making America competitive in business.

Again, USD and INR has shown range bound movement—rupee can have brief spell of depreciation followed by appreciation. While a stronger dollar might result in short-term capital outflows for short-term as investors flock to dollar-based assets, on a positive note, a lower rupee might provide an export advantage, potentially boosting revenues in sectors like textiles, manufacturing, and agriculture. Moreover, volatility in Indian equity markets has already started showing signs of reduction.

The trade finance business outlook of the banks is neutral as tariff policy of the US will disrupt trade. Besides, cross border flow of capital and dollar liquidity will be comfortable as US Fed is in accommodation mode.

India may see shifts in foreign direct investments (FDIs) during Trump 2.0. Apart from it, US will have a positive bearing on India’s defence exports that have surged over 30 times in the last decade.

Indian generic drug exports to the US may face tariff revisions, potentially affecting the pharmaceutical sector. A slowdown in US discretionary spending due to trade wars could negatively impact India’s IT exports.

If US interest rate cuts are delayed, FPI inflows into India could diminish, as there is an inverse relationship between US interest rates and FPI flows into emerging markets.

“Any delay in US rate cuts could also delay India’s repo rate cuts, prolonging pressures on the Indian economy, which is already seeing a slowdown in earnings growth,” says Nitin Aggarwal, director of Investment Research and Advisory at Client Associates.

With over 4.5 million Americans of Indian descent, according to the 2020 US Census, the Indian diaspora eagerly awaits the new administration’s policies and initiatives aimed at this significant community.

“Trump’s victory will have a profound impact on US-India bilateral ties,particularly in defence, technology, trade, geopolitics, and the Indian diaspora. The Trump administration would likely emphasise an “America First” approach, promoting domestic growth, controlling inflation, and encouraging re-shoring and industrialisation,” says Sachin Alug, Founder, NLB Services.

The US has become one of India’s foremost investors, with significant contributions across sectors like technology, infrastructure, renewable energy, and manufacturing, fuelling India’s development, creating jobs, and positioning India as a competitive global player

Areas like cybersecurity, data protection, AI and Machine Learning, and the regulation of user data and content oversight will be impacted by the new administration’s approach, influencing the global demand for AI-specific talent, including in India. The new administration’s priorities will also shape the collaboration on climate change and technology transfer, both of which are crucial areas of cooperation for India and the US.

The market is essentially gearing up for tariff increases, further tax cuts and the fall out of these measures on US inflation, Fed policy action and US debt.

In the near-term, a Trump administration could lift US growth due to likely tax cuts and greater deregulation. But the medium-term implications, as per HDFC Securities, are less straightforward. This is as tariffs hikes could be inflationary, negatively affecting consumer demand and hit US manufacturers dependent on global imports.

Trump’s presidency has focused on policies favouring domestic business growth. If we see a similar approach this term, expectations of corporate tax cuts and a stance on trade protectionism could further boost the dollar’s strength against emerging market currencies. For India, a stronger dollar means that imports may become more costly, potentially increasing inflation pressures. However, it’s also a potential positive for Indian exporters, who may find their goods more competitive in the global market. Investors would be wise to monitor USD-INR closely, as currency fluctuations can have varying impacts across sectors.

Among the laggards, the auto sector may face challenges if Trump reintroduces tariffs or increases import taxes, especially affecting Indian manufacturers that rely on US parts or have substantial export exposure. A stronger dollar may make imports more expensive, adding cost pressures to Indian auto production.

Secondly, with Trump’s preference for traditional fossil fuels, demand for renewable energy technologies may decline, potentially slowing global investments in renewables. Indian firms with international renewable energy ties may see weaker momentum if fossil fuel investments rise globally, overshadowing renewable initiatives.

Trump’s policies might boost US growth, pushing up global material prices, which could make construction more expensive in India.

Trump’s focus on fossil fuels and deregulation, leading to higher global oil and natural gas prices may translate to higher import costs for oil, impacting fuel-sensitive sectors like transportation and aviation in India.

Trump’s policies bring both short-term volatility and potential long-term shifts in market dynamics. For Indian investors, the key will be closely tracking trade patterns, FII flows, and commodity prices to make informed investment decisions.

Thus, for those looking to balance growth with risk, established sectors that exhibit value-based growth may offer strong opportunities even amid uncertainty.