Issue No. 9 / May 16,2015

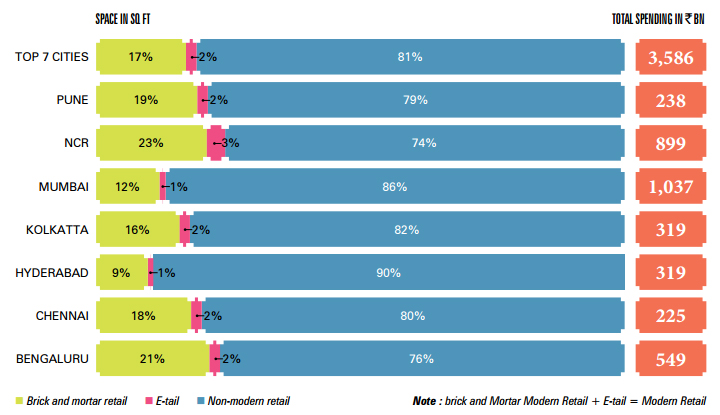

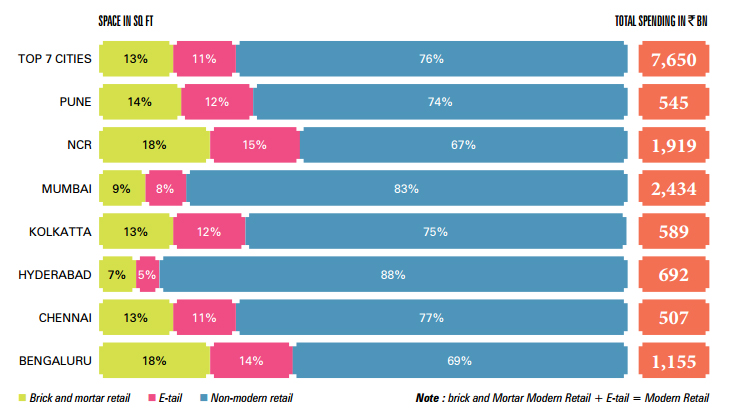

India loves shopping. To put that in perspective, currently, the total retail spending in the top seven cities of India amounts to Rs.3,58,600 crore (US $60 billion). Mumbai alone accounts for 29 per cent market share, followed by NCR and Bengaluru, at 25 per cent and 15 per cent respectively. The total retail spending in the top seven cities of India is projected to more than double to Rs.7,65,000 crore (US$ 127.5 bn) by 2019. The majority of this penetration is by brick and mortar stores. E-tailing, however, is fast picking up. Currently, NCR has the highest penetration of E-tail in India, at 3 per cent. The corresponding number for Mumbai and Hyderabad is 1 per cent each.

E-tailing is the sector which is projected to witness the most growth, from Rs.7200 crore (US$ 1.2 bn) in 2014 to Rs.83900 crore (US$ 14bn) in 2019, resulting in a phenomenal annual growth rate of 64 per cent.

Now let’s look at the cities. Bengaluru has the highest per capita penetration of modern retail in India, at 1,323 sq ft per 1,000 population. This is followed by Pune and Chennai, at 1,002 and 1,001 sq ft per 1,000 population respectively. Kolkata has the lowest penetration of modern retail in India, at 569 sq ft per 1,000 population. However, Mumbai ranks the lowest, at 1,047 sq ft when the population for households earning more than Rs.300,000 per annum is considered. This implies that among the high income group, Mumbai residents are the least serviced in modern retail terms, despite Mumbai accounting for the highest share in the retail market, at 29 per cent.

In a country with severe land shortages, mall space is hard to come by. There is a huge disparity in mall space across the country. NCR, for example ranks first in terms of mall space per capita in India, at 536 sq ft per 1,000 population. This is followed by Bengaluru and Pune in second and third place respectively. At the other end of the spectrum, Hyderabad is ranked last when it comes to per capita mall space penetration in India, with just 193 sq ft per 1,000 population. Mumbai, too, fares poorly in terms of mall space penetration per capita, at just 350 sq ft per 1,000 population. This is much lower than the average penetration in the top seven cities.

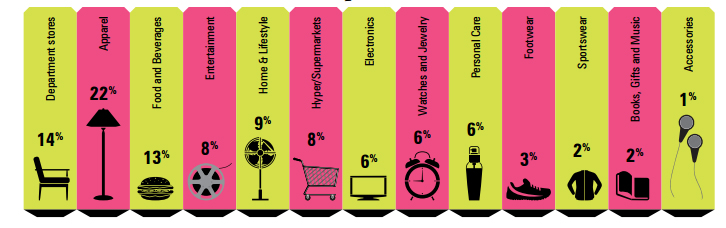

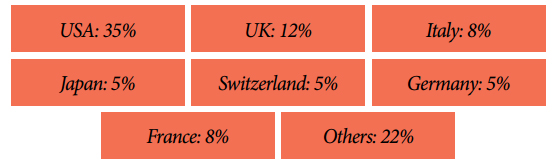

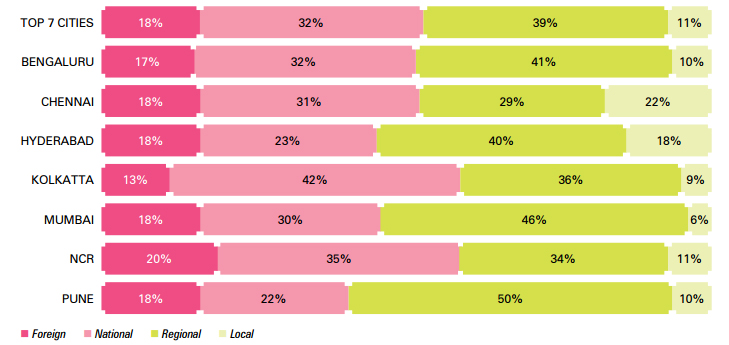

When it comes to products sold, apparel is the largest product category in India, with a share of 22 per cent in the occupied modern retail space of the top seven cities. This is followed by department stores and food and beverages categories, at 14 per cent and 13 per cent respectively. What’s interesting is that the top three categories represent around half of the total occupied modern retail space in these seven cities. Even in these categories, Indians have a clear preference for foreign goods, and that too from a few select countries. Brands from more than 33 foreign countries are sold through modern retail outlets in India. However, the top seven countries contribute towards a majority of the share in this, at 78 per cent. USA contributes a massive 35 per cent of all foreign brands present in India. This is followed by the United Kingdom, at 12 per cent, While Italian and French brands account for an 8 per cent share each, Japanese, Swiss and German brands represent 5 per cent each.

By Neeraj Varty