There are many who look at match-set-go arranged marriages as easier said than done, but for some it is a magical thing that works wonders. The magic, Nilima and Chandra Shekhar Ghosh, founders of Bandhan Bank, discovered in their arranged marriage was—when two partners have a good mutual understanding between themselves, they can handle any situation. This story is about Chandra Shekhar’s amazing journey from working at his father’s sweet shop to owning the largest micro-finance network in India in less than 15 years and thereafter venturing into Banking. The husband-wife duo share the journey traversed by Bandhan and the various challenges they faced, with Corporate Citizen

On their entrepreneurial journey, the husband and wife duo have together effectively handled the daunting task of building and running India’s first and largest micro finance network and then venturing into Banking, with great success. As the chairman and managing director of Bandhan Bank, headquartered in Kolkata, Chandra Shekhar today is heading a banking network operational in 27 states with 615 branches across India, with over 19,500 employees. The numbers indicate the years of hard work and dedication that has gone into achieving it. “I am committed to the poor and that will always remain my focus,” says Chandra Shekhar.

Since Bandhan became a bank, Nilima says, life has changed for Chandra Shekhar. “I feel proud when I see him in newspaper or on a TV show. He really deserves it for his hard work, perseverance and determination,” she says.

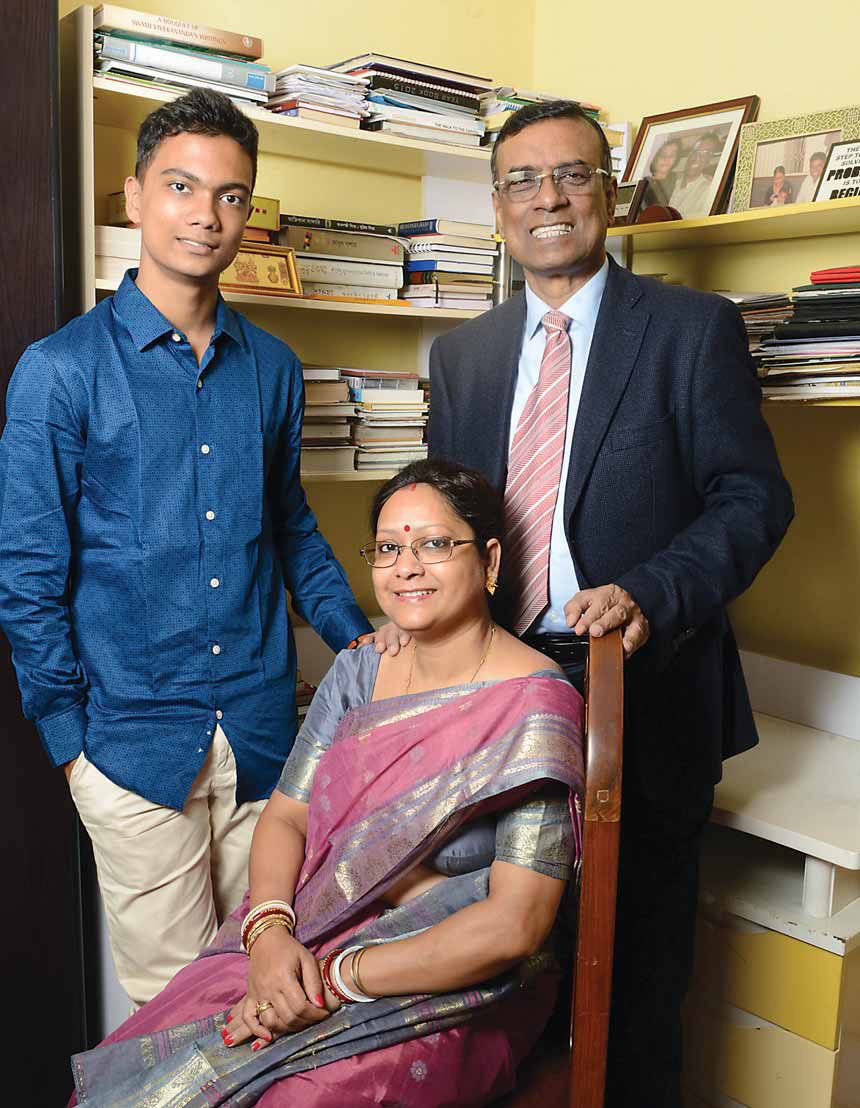

Though it was an arranged marriage, it was a poor-boy-marries-a-rich-girl story, says Chandra Shekhar. “I thought it will be tough for her to adjust to my ordinary lifestyle, but she got easily adapted to my family and the hardship without difficulty,” recalls Chandra Shekhar, while relaxing with his wife in their house in Kolkata. They got married in the year 1993.

It is true, says Nilima, that one has to adjust. “I had to compromise on the lifestyle I enjoyed before marriage, but in return I received lots of love and affection. My father and Chandra Shekhar’s father were friends, so his joint family accepted me like their daughter after our marriage,” she said. Nilima grew up in an affluent joint family from Agartala, Tripura, with her four sisters and two brothers and her father was in the transport business.

For Nilima it was about moving from one joint family into another after marriage. Living in a joint family, she says, has its advantage. “It gave me a tremendous sense of security and support to pursue my goals. I would not have managed it without their support. The concept of a joint family creates family values for the children,” she adds.

Both Chandra Shekhar and Nilima are religious and maintain a very humble lifestyle and live in a joint family with Chandra Shekhar’s brother. Their house is in a middle-class locality in Kolkata. The only difference over the years, Nilima says, “is the couple of security guards manning our small house, as many people come to visit us, looking for jobs and donation.”

His morning began with helping his father in his small sweet shop before going to school. He recalls that he would open and clean the shop in the morning and often make chapatis and serve breakfast to customers

“Bandhan has changed my life by giving me a loan on easy terms to buy sewing machines. This has helped to increase my monthly family income. Now I can deposit my savings with Bandhan Bank and earn interest.”Sunitajana, member of Bandhan’s Women Self Help Group, West Bengal

Chandra Shekhar was born into a family of Bangladeshi refugees who settled in Agartala. His morning began with helping his father in his small sweet shop before going to school. He recalls that he would open and clean the shop in the morning and often make chapatis and serve breakfast to customers. A bright student, Chandra Shekhar moved to stay with his uncle in Bangladesh for higher studies after his schooling in Agartala. He completed his master’s in statistics from Dhaka University in 1985 and then joined BRAC, an international development agency based in Bangladesh. “Unfortunately, I lost my father the same year and as the eldest son of the family I had to shoulder the family responsibility,” he said. He returned to India and started working for several NGOs and giving tiny loans to help the poor in Kolkata’s suburban town of Konnagar.

It was a very humble beginning, says Chandra Shekhar. It all started with him taking the big risk of leaving a steady job at the Village Welfare Society, where his monthly salary was Rs.5,000. “My parents opposed my decision of leaving the job, but I was determined and started Bandhan, an NGO, in 2001 with a borrowed capital of Rs.2 lakh and two employees,” he said. It was a tough call, since he was the only earning member in the family. “I had only two options, either make it a success or commit suicide,” he says.

Nilima also joined her husband in the dream to make Bandhan a success. “We were very shaky about the outcome of his venture. But I had seen his willpower and that gave me confidence,” she said.

Realising that success lies in building strong links with people and understanding the ground reality, the husband and wife duo set out on a difficult path of doing good for the society through financial inclusion and committed themselves to touching the lives of marginalised people by offering them financial services at affordable cost. “Mainstream banks failed to reach out to rural customers and I wanted to fill that gap where the need for banking was higher. Which is why I started Bandhan. Bandhan means bond or togetherness,” said Chandra Shekhar.

‘We built the relationship of trust with our need based services for rural folk. We have minimum paper work for disbursement. We help our beneficiaries to choose the correct product within their repayment capacity. All this has paid off’

Chandra Shekhar had no degree in finance or management, but he says that the idea of building a proper financial system for the poor came to him when he was working as a field officer for BRAC. “Working in one of the poorest areas in Bangladesh had given me exposure to the ground reality of the need for a proper financial system for the poor. It was a huge learning experience and thus emerged the possibility of banking the unbanked,” says Chandra Shekhar.

Chandra Shekhar was further exposed to the needs of marginalised people while working in India. He realised the greater need for an organised money lending system to save the poor, the farmers and daily wage workers from exploitation by unscrupulous local money lenders who charged 100-200 percent interest on small loans. “I made up my mind that this was the area I should get in, and act as a link between the bank and poor people.”

In 2006, Chandra Shekhar turned Bandhan into a non-banking financial company (NBFC), called Bandhan Finance Services Limited. Thereafter, he did not look back and scripted his success story with constant support from his wife. “We have experienced many ups and downs, but with sheer hard work and determination, we steadily nurtured their goal and gained the confidence of the rural people.”

The biggest challenge Chandra Shekhar and Nilima faced was creating trust among the poor people. Chandra Shekhar and Nilima would go door to door and visit villagers personally to try and win their confidence. They would sometimes receive threats from money lenders, but that did not deter them from their goal. When threats did not work, rumours were spread among villagers that the couple were into human trafficking. However, Chandra Shekhar said, “The unconditional support from the then district magistrate helped us in overcoming all the obstacles and the women from the villages slowly started showing faith in us.”

The second challenge Bandhan faced was raising funds from banks to provide small loans. Chandra Shekhar recalled that no bank would give them loans. “I was desperately knocking on the doors of every bank for funds with my proposal, when the executive director of the Small Industries Development Board of India (SIDBI), Brij Mohan, showed confidence in Bandhan and granted Rs.20 lakh in 2002. That was the turning point of my life,” said Chandra Shekhar. He still remembers how Nilima worked hard for two days to give a facelift to their small office before the SIDBI officials visited for inspection.

Later the International Finance Corporation (IFC) and SIDBI became investors and picked up equity in Bandhan. Many banks and financial institutions started funding Bandhan for microlending. Today the company has over 13,000 dedicated employees working in Bandhan branches spread across the country.

After their son was born in 1997, Nilima had to cut down her active involvement with Bandhan for some time. But she continued to lend her support to Bandhan and managed both home and work efficiently. Once their son entered high school, she came back to shoulder many new responsibilities in the company. “My strength is my joint family. I could not have managed it without their support,” says Nilima.

The day the RBI announced his banking licence, Chandra Shekhar was flooded with praises. “Many of these wishes were from those banks that had rejected my application to open accounts with them when I was struggling to form my company,” he said

Bandhan addresses the dual objective of poverty alleviation and women’s empowerment. It helps in the crucial fields of education, health, employment and sustainable livelihood. “Today, Bandhan touches the lives of over 70 lakh people with a loan book of Rs.10,000 crore. It has a base of over 2.64 lakh women self-help groups,” Chandra Shekhar said. On how they did it, he says, “We built the relationship of trust with our need-based services for rural folk. We have minimum paperwork for disbursement. We help our beneficiaries to choose the correct product within their repayment capacity. All this has paid off and today our bad loan is negligible at 0.01 percent and the current net profit is Rs.428 crore on a revenue of Rs.1,200 crore as on March 2015.” Chandra Shekhar has received the Senior Ashoka Fellowship in 2007 for his outstanding contribution to creating entrepreneurship and women’s empowerment. Bandhan was also ranked 1st in India and the 2nd in the world as per the Forbes list of the world’s top 50 microfinance institutions, in 2007.

Chandra Shekhar says that it was the biggest transformation for Bandhan when it was selected for granting a banking licence by the Reserve Bank of India (RBI) in April 2014. “Bandhan and IDFC (an integrated infrastructure financing company) emerged winners among a list of 25 hopefuls. These were new banking permits given by RBI for the first time in ten years. Bandhan became the first microfinance company in the country to get a banking licence, and post-independence, it was the first new bank to come up in eastern India,” he informed.

“It was tough to compete with big players but we were confident of winning the license because our focus was always on the financial inclusion of the marginalised people,” said Chandra Shekhar, proudly sitting at his large office at Salt Lake in Kolkata. Nilima remembers the tension they had gone through before RBI announced the names for the banking license. “I was worried about his health, but finally we made it,” she adds.

RBI had received 27 applications in July 2013, after which Tata Sons and Videocon Group withdrew, leaving 25 contenders in the fray. The Anil Ambani Group, Aditya Birla Group, Bajaj Finance, Muthoot Finance, Religare Enterprises, Shriram Capital, Srei Infrastructure and Magma Finance were the strong private sector participants, says Chandra Shekhar. He informed that RBI had assessed the quantitative and qualitative aspects of the applicants, including their financial statements, 10-year track record of running their business, the proposed business model for the bank, demonstrated capabilities for running a bank, plan for expanding inclusion, and the culture of compliance and integrity.

The day the RBI announced his banking licence, Chandra Shekhar was flooded with praises. “Many of these wishes were from those banks that had rejected my application to open accounts with them when I was struggling to form my company,” said Chandra Shekhar.

“Mainstream banks failed to reach out to rural customers and I wanted to fill that gap ... which is why I started Bandhan” - Chandra Shekhar Ghosh

Over the 18 months since Bandhan received the banking license, it complied with RBI’s conditions and met all the criteria easily to become a bank. It started the journey as a bank on December 23, 2014, with financial inclusion as the prime focus. It has received capital support from its key stakeholders—SIDBI, International Financial Corporation (IFC), Caladium Investment Pte Ltd (a company managed by GIC Special Investments Pvt. Ltd), Bandhan Employees Welfare Trust, and a few individuals. Union Finance Minister Arun Jaitley inaugurated the Bandhan Bank at the Science City Auditorium in Kolkata at a function attended by regulators, policymakers and luminaries from the financial sector and corporate India. Bandhan commenced its operations as a universal bank, which presently has operations in 27 states with 615 branches, 2,022 Doorstep Service Centres and 205 ATMs.

In less than a year, the number of branches has expanded to 615 and 205 ATMs, with a deposit base of Rs.4,000 crore. The bank has two divisions —micro banking and general banking—and it offers complete retail financial solutions, including a variety of savings and loan products. The bank will have to go for stock market listing within three years as per the RBI guidelines.

“Traditionally, most banks collect money from urban and rural segments and deploy the money in the corporate and retail sectors. Our bank would like to take the money from both rural and semi-urban segments, but we promise to the give the money back (in the form of credit) to the rural and semi-urban sectors also,” says Chandra Shekhar. He adds that Bandhan Bank will stay away from large corporate credit and concentrate on credit to micro and MSMEs. They have also waived processing charges for loans up to Rs.25,000.

Bandhan Bank is now focused on improving the skill-sets within the current workforce for providing efficient banking services. It enables the rural poor people to park their small savings in the bank, rather than getting duped by money depositing firms and chit fund companies who promise big returns and cheat poor people.

Chandra Shekhar’s success lies in the strong links he has built with the people, and his understanding of the ground reality. He often goes and meets his microcredit customers. “Main-stream banks have failed to reach out to rural customers where the need for banking is higher. They have not found a workforce in the villages. We are trying to fill that gap. We have a strong rural base in the eastern region. The east always has a high number of small savings depositors. We offer products that suit the needs of the people,” assures Chandra Shekhar.

Nilima decided to create a platform to help rural artisans and set up Bandhan Creations n 2012. It is a retail chain which offers a range of local ethnic handloom and handicrafts from different parts of rural India. “Craft and textiles are our proud heritage. Our focus is to support the livelihood of local artisans and help them to revive their art and facilitate the market linkage for their traditional art and craft,” said Nilima, director of Bandhan Creations.

Nilima regularly interacts with the artisans and advises them on the quality, design and pricing. Most of these artisans are beneficiaries of Bandhan Microfinance. She is now planning to explore the possibility of selling the products online and creating an infrastructure for artisans in Kolkata, where they can come and work. She is also the editor of ‘Sanko’ an in-house magazine for the Bandhan family to express their views and experience.

Chandra Shekhar is a workaholic and leads a very simple lifestyle. On holidays, he prefers to spend time with his wife and son, Anshuman, at home and enjoy good food cooked by Nilima. However, Nilima complains that the most boring holiday she had with Chandra Shekhar and their child was when they went to Washington, USA, a few years back. Talking about the trip, she said, “It was our first trip to the US in 2012. After checking into a hotel, he left for work with a promise that he would come back and take us out for sightseeing. He finally turned up at night when I and my son were asleep. Work was always his first priority.” Chandra Shekhar quickly responded with a wide smile and reminded her that their recent trip to Cape Town was pure holiday and no work.

Son, Anshuman, says Nilima, is a XI standard student in the Future Foundation School in Kolkata. He is a professional sprinter, who participates in state- and national-level championships. Talking about his son’s future, Chandra Shekhar says, “He is still studying. But in the future he has to take the call whether he wants to join Bandhan or do something else. Neither I, nor my wife will dictate terms to him.”